The fintech sector is exploding, with global investment reaching $210 billion in 2021 alone. However, 75% of fintech startups fail within the first 20 months.

So, What sets successful fintechs apart?

A robust Fintech enterprise architecture (EA) explicitly designed to address the challenges of the dynamic fintech landscape. Scale securely, innovate quickly, and deliver exceptional user experiences with EA’s technology foundation and integration mechanisms.

Fintechs find it challenging to comply with financial regulations, prevent data breaches, and expand to meet demand without strategic enterprise architecture.

As emerging technologies and competition heat up in the fintech marketplace, the costs of poor architecture multiply. This raises various questions like:

- How can enterprise architecture enable fintech growth?

- What architectural principles guide the development of flexible yet secure fintech infrastructure?

- What examples illustrate effective EA in fintech?

This blog post will explore why every aspect of fintech—from APIs to analytics—relies on strong enterprise architecture for sustainable innovation and market leadership.

Let’s begin!

Understanding Fintech Challenges

There is a continuous digital transformation in finance. From mobile payments to algorithmic trading to blockchain networks, financial services leverage cutting-edge technologies to offer new products and improve efficiency. The innovation pace shows no signs of slowing.

Explore ValueCoders' Enterprise Architecture expertise for scalable, innovative solutions.

However, this dynamic landscape also creates significant technology and business challenges, such as

- Fintech infrastructure must adapt to ever-changing regulations such as PSD2, GDPR, and open banking requirements.

- Cybersecurity threats that come with handling highly sensitive customer financial data.

- Growing competition from an explosion of nimble startups attacking all areas of financial services.

- Customer expectations for seamless, personalized experiences across channels.

- Cloud adoption enables innovation but also data governance risks.

- Rising infrastructure complexity from supporting everything from payments to wealth management.

To keep pace, Fintech software development services must rapidly develop and iterate products. But technical debt accrues quickly without robust architecture. Multi-platform apps, third-party data services, and multiple payment methods can be integrated with core banking systems.

Fintechs risk falling behind if the technology infrastructure can’t evolve as fast as the external environment. That’s why strategic IT in Fintech enterprise architecture is crucial.

Also read: Digital Transformation Strategies & Benefits

The Crucial Role of Enterprise Architecture

Enterprise architecture is a conceptual blueprint that standardizes and optimizes technology systems to align with business objectives and drive growth. For fintechs, EA establishes guardrails and principles for building secure, scalable technology infrastructure that allows innovation at speed.

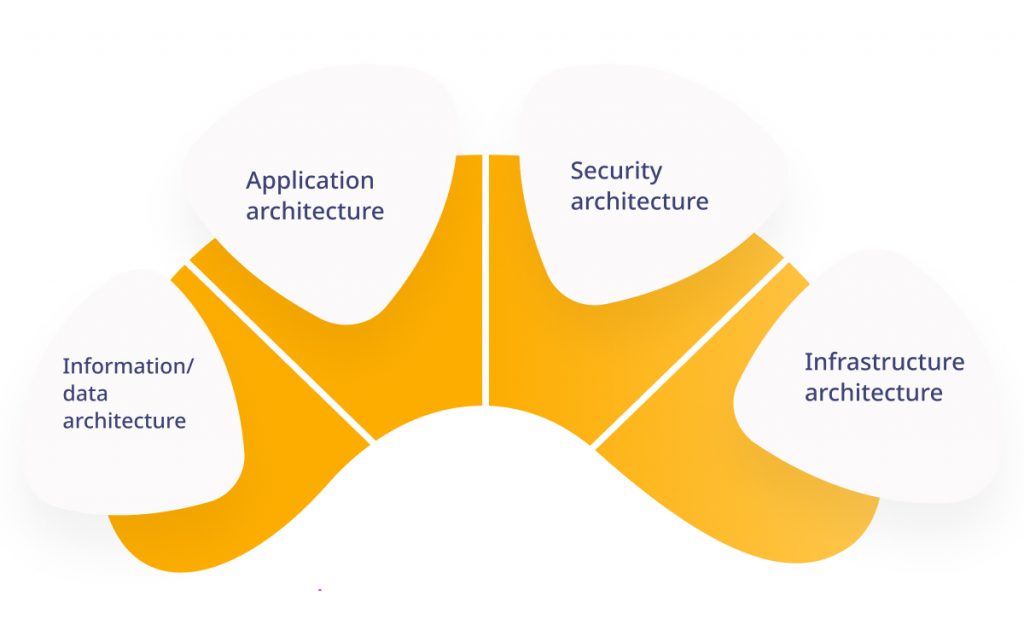

EA consists of models across domains, such as

- Information/data architecture: The structure and distribution of data across structured databases, data lakes, and analytics systems.

- Application architecture: Guidelines for developing customer-facing apps, back-end processing systems, integration mechanisms, and APIs.

- Security architecture: Policies for access control, encryption, cybersecurity tools, and regulation compliance.

- Infrastructure architecture: Strategies for hosting, connectivity, and DevOps pipelines based on factors like cloud vs. on-premises.

With dynamic threats and opportunities in the fintech environment, technical debt and ad hoc systems won’t sustain long-term growth. Organizations require stable yet flexible technology foundations for rapid experiments and innovations without introducing bugs or security flaws.

A robust Fintech enterprise architecture is crucial to sustain innovation and achieve market leadership because:

- It enables fast development of new offerings without compromising the stability and performance of existing ones. Without planned architecture, technical debt accumulates as legacy and new systems are hastily integrated.

- A scalable technology roadmap ensures infrastructure seamlessly handles transaction spikes during peak seasons. Poor architecture cracks under load.

- Modeling information flows and access controls help comply with financial data regulations out of the box. Weak architecture requires expensive rework to meet compliance.

- Abstracting infrastructure using APIs and cloud-native tools provides cost transparency and flexibility to optimize spending. Ad hoc architecture risks cost overruns.

Overall, strong EA technology in finance minimizes wasted rework, performance issues, and system downtimes – establishing solid data, application, and integration foundations for the long term.

Explore innovation potential with ValueCoders' EA strategies for FinTech brands.

To stay competitive, a Fintech application development company must scale rapidly to support millions of global users transacting 24/7 while ensuring 100% uptime. EA enables on-demand scalability by:

- Building stateless systems loosely coupled using microservices and APIs to scale specific functions without affecting others.

- Leveraging cloud infrastructure for storage, computing per business needs.

- Designing decentralized data architecture, avoiding single points of failure.

- Abstracting underlying infrastructure so teams can adopt new technologies like serverless computing faster.

With an evolving EA roadmap, fintechs can smoothly absorb exponential jumps in customers, transactions, and data volumes to meet growth goals.

Also read: Leading Services & AI’s Role in FinTech

Benefits of Strong Enterprise Architecture

Fintech enterprise architecture implementation across complex fintech systems is undoubtedly an ambitious and long-term project. An organization needs the appetite to invest in EA for the future.

Unlike consumer-facing features, the playback from enterprise transformation comes gradually over quarters and years, not days and weeks.

However, well-planned enterprise architecture focused on flexibility bolsters competitiveness directly. Once firmly established, strategic EA delivers sustained advantages spanning security, scalability, efficiency, and innovation capability.

The upfront effort results in fintech-wide data, application, and integration foundations for the long term. A robust EA offers a range of crucial strategic and operational Fintech business architecture benefits, including:

1. Security and Compliance

Fintechs must embed security and compliance across their technology landscape – in applications collecting sensitive customer data, APIs transmitting financial transactions, cloud servers storing account details, analytics tools processing data, and more.

A strong Fintech enterprise architecture establishes technology frameworks for Fintech and protocols like OAuth, end-to-end encryption, MFA, key management, perimeter security, and stringent access controls. Confidential data is protected without compromising experience.

By codifying regulatory principles during the design phase rather than bolting on controls later, products meet compliance needs from launch. To proactively identify control gaps, enterprise software development teams constantly evaluate new privacy and data sovereignty regulations.

Integrating GRC tools and using infrastructure-as-code for provisioning and managing systems also improves security posture over time.

2. Better Customer Experiences

People expect finance apps to be as smart and intuitive as Big Tech. EA focuses on creating personalized journeys by understanding customer pain points and mapping technology to desired experiences.

For instance, identifying the need for tracking complex investments leads to developing a dashboard with customized metrics, alerts, and commentary by linking core brokerage data with analytics tools, even bots of AI and ML in Fintech.

The dashboard surfaces via web and mobile apps, meeting omnichannel expectations. Leveraging cloud and micro-frontends allows feature enhancement without rewriting entire applications.

APIs connect frontends to required services such as accounts, transactions, market data analysis, and predictions seamlessly in the background. Strong integration architecture prevents broken journeys.

Also read: Top 10 Finance App Ideas To Kickstart Your Fintech Startup

3. Better Insights

Many fintechs miss growth opportunities hidden in their data. Architecting a strong analytics foundation helps leverage AI/ML for actionable intelligence – like alerts on payment failures, risk modeling for lending decisions, personalized investment recommendations, etc.

EA outlines technologies supporting data pipelines – from data lakes aggregating siloed data, applying quality checks and transformations to data marts tailored for departments, to models generating insights like forecasts, customer lifetime value, etc.

Flexible scaling data infrastructure allows easier correlation analysis to uncover Fintech trends in mobile app development. Strategic EA develops the capability for rapid data collection from more internal and external sources – further refining insights over time.

4. Addressing Scalability

To handle exponential jumps in transactions and customer data as fintechs rapidly widen their user base, the underlying systems architecture must be inherently and infinitely scalable on demand. Robust Fintech enterprise architecture centers on flexibility and distributed design rather than monoliths.

For instance, a microservices-oriented architecture allows individual functions to be upgraded by just horizontally scaling out more containerized instances to handle spikes in API traffic. Polyglot persistence ensures storage scales efficiently – hot transactional data in fast databases, while bulk data lakes use cost-optimized object storage solutions.

Serverless computing allows event-driven scaling of processing capacity according to real-time needs. Large fintechs leverage thousands of small functions stitched by resilient messaging queues. Strategic use of CDNs smoothly absorbs high traffic across globally distributed websites and apps.

5. Streamlining Operations Through Integration

To achieve straight-through processing across its technology landscape, a Fintech enterprise architecture focuses on API-led connectivity. Powerful integration platform as a service (iPaaS) tools create interconnected systems that exchange data seamlessly.

Prebuilt adapters integrate legacy systems with modern cloud solutions and third-party services like KYC verification, risk analysis, compliance policy updates, etc. Real-time data replication across CRUD APIs powers dynamic operational dashboards – creating a single pane of glass across systems to smooth workflows.

No matter the variety of origination sources – bank records, mobile transactions, web forms, etc. – strongly buffered message queues absorb data, allowing asynchronous processing for resilience. Events trigger relevant workflows in downstream systems using integration middleware.

6. Innovation and Technology Adoption

Rather than playing catch up, a Fintech software development company must track emerging technologies and rapidly prototype new solutions before competitors. However, rebuilding entire Fintech technology stacks inhibits experimentation velocity and heightens risk.

Fintech Enterprise architecture emphasizes progressive modernization – abstracting legacy complexity behind well-documented APIs allows skilled developers to consume core services while innovating in parallel. New UI layers integrate microfrontends. Cloud native stacks scale robustly.

Service mesh routing directs traffic, that allows testing of experimental microservices with a subset of users first. Infrastructure-as-code templates ease replication of production environments for ops. Gradually transitioning to event-driven, serverless systems centered around data streams aids in adopting ML.

Optimize costs and resources with ValueCoders' efficient Enterprise Architecture solutions.

7. Cost Efficiency and Resource Optimization

While agility and resilience have a cost, strategic enterprise architecture protects against overspending. Beyond storage/bandwidth optimization, steering focus from Capex investments towards more Opex reduces TCO while maintaining flexibility.

FinOps frameworks to track cloud resource utilization in real time – identifying idle and underutilized components for deprovisioning. Auto-scaling ensures expenditure follows demand contours tightly. Workload placement decisions optimize latency and data gravity considerations, balancing performance with pricing.

Also read: Top 10 Fintech Software Development Companies

ValueCoders Case Studies in the FinTech Sector

As discussed, a strong Fintech enterprise architecture (EA) is vital to building innovative Fintech scalability solutions that scale securely. Many organizations partner with expert technology providers in creating robust foundations for growth. Below are examples of ValueCoders’ EA-driven development projects in the fintech domain:

1. Finance Mobile Application

An iOS/Android mobile app developed by ValueCoders allows short-term personal loans to be applied for and received. Features included intuitive interfaces, bank integrations for account verification, credit modeling using AI, as well as biometric authentication aligning with local compliance regulations.

Effective enterprise architecture enabled the rapid development of core loan management modules. API connectivity to credit bureaus and bank accounts powered instant decisioning while robust data pipelines streamed application information to the underwriting platform. Extensible cloud infrastructure seamlessly handled launch traffic spikes.

2. Donation Management Software

For an NGO managing fundraising globally, ValueCoders built a customizable web CRM consolidating donor interaction. Granular access controls secure sensitive constituent financial data while exposing APIs to connect engagement histories across channels from websites to mobile caching layers for field workers.

Flexible integration architecture enabled replacing locally hosted systems with SalesForce and payment gateways via iPaaS, highlighting the advantage of loosely coupled over monolithic design. The future-ready foundation, integrated with fundraising software, supports scaling campaigns and volunteer coordination.

3. Online Crowdfunding Platform

ValueCoders leveraged blockchain technology to develop a crowdsourcing system allowing fundraisers to easily create campaigns for causes in various sectors like education, small business, music, etc. Donors could seamlessly support global projects.

Key architecture decisions included building a decentralized identity and access management layer for privacy and using smart contracts to establish fundraising rules and disburse funds. Global access to low-latency websites was enabled with a multi-cloud deployment and a CDN, and dynamic load balancing handled demand spikes.

Extensive use of Docker containerization and test automation aided the continuous delivery of feature upgrades aligned to community feedback. The well-architected platform continues attracting new project categories like Non-Fungible Tokens (NFTs), supporting the growth of the crowdfunding ecosystem.

With a scalable, secure, and compliant foundation guided by a long-term technology roadmap, fintech can sustain rapid innovation critical for flourishing in a hypercompetitive space. As evident in the examples, ValueCoders leverages deep Fintech software development architecture expertise across domains in building and enhancing high-performance Fintech scalability solutions ready for the future.

Embark on a journey of success with ValueCoders' expert Enterprise Architecture.

Final Thoughts

As fintech complexity rises, only resilient enterprise architecture enables continued innovation. The fast-changing financial marketplace demands risk-evolving products while maintaining stability, security, and compliance. Legacy infrastructure crumbles under the pressure of scale – leaving customer relationships vulnerable.

Strategic and agile technology blueprints secure customer trust – navigating fintech through the challenging waters ahead into a future driven by open banking APIs, real-time embedded finance, and AI-powered experiences. The time for Fintech enterprise architecture is now.

Key Takeaways:

- Robust EA underpins compliant and scalable systems

- Integrated, cloud agile architecture boosts operational efficiency

- Data and analytics foundations power intelligent product development

Does your fintech have gaps in architecting secure innovation? With engineering expertise across global banking, payments, and lending systems, ValueCoders is a trusted technology transformation partner for the financial industry. Our fintech architecture consulting supports long-term growth. Get in touch for a strategic discussion with our experts.