Project Synopsis

The objective was to create a mobile and web-based application at the intersection of Fintech and ed-tech that seeks to empower Indian teenagers with financial awareness and literacy.

After collaborating with Valuecoders, the client expected a platform comprising a market simulator where teens could invest their virtual money into Crypto Currency, Stocks, and Mutual Funds that real-time market prices would drive.

Through this, they can attain virtual gains on different assets, which they can cash out for discounts when they make purchases using the card. The engaging environment also allows users to create competitive leagues and develop a community like playing fantasy sports.

Project Requirements

This application will enable teenagers to invest in virtual cryptocurrency, stocks, and mutual funds. This app is useful because they can make substantial gains on these assets while also getting discounts on real-life purchases when they purchase with their card.

Along with that, multiple features are attached to the application to gain maximum benefits by investing and shopping.

- It offers an organized set of curated learning modules from industry experts, such as DSP and Edelweiss MF. The user can answer a short quiz that allows them to win virtual money.

- A certificate will be provided after evaluating the user on the content.

- The client wants a fully secure smart prepaid card launched in partnership with an RBI licensed PPI, which gives users insight into managing their money and preparing for a secure future in the real world.

- The card can be used in physical stores (contactless and numberless) and online via a linked digital wallet on the app.

- The user will get many opportunities to win rewards, perks, and great deals on their favorite brands.

- The virtual winnings on this simulator can then be redeemed and used to get real discounts on the prepaid card.

Type Of Users

End Users (Teenagers)

Key challenges

Challenge no. 1 – Firebase integration for app notifications

How we resolved – Integration was successful with the help of our expert Firebase developer’s team

Challenge No.2 – Doing live stocks Update

How we resolved – TwelveData, 3rd Party API, which provides real-time Stock Data (BSE) was successfully integrated

Challenge No.3 – Real-time crypto currency updates

How we resolved – CoinGecko, 3rd Party API, which provides real time Crypto Currency data, was successfully integrated

Challenge No.4 – Certificate generation (HTML to PDF conversion)

How we resolved – OpenHTMLToPDF and JSoup used to generate dynamically populated PDF from static HTML page

Challenge No.5 – Providing wallet facility

How we resolved – PayPoint, 3rd Party API integration, is done to provide seamless wallet functionality

Solution Implementation

Process

- After code review, the developer maintains a separate Git branch and merges the code into the master

- The master(docker) branch is enabled with CI/CD that deploys the build-in staging branch or manual deployment is done

- Once testing is complete, the API is deployed in the live environment

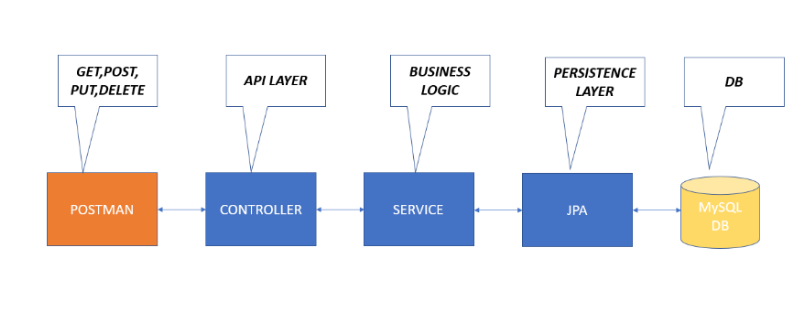

Architecture

Results

The app turned out to be a great platform for teenagers to invest in virtual cryptocurrency, stocks, and mutual funds. This app enabled them to make substantial gains on these assets while also getting discounts on real-life purchases with their card. The users get:

- Chance of gaining virtual gains on a variety of asset classes

- Chance to win virtual money

- Fully secure smart prepaid card

- Chance to win rewards, perks, and great deals on every purchase