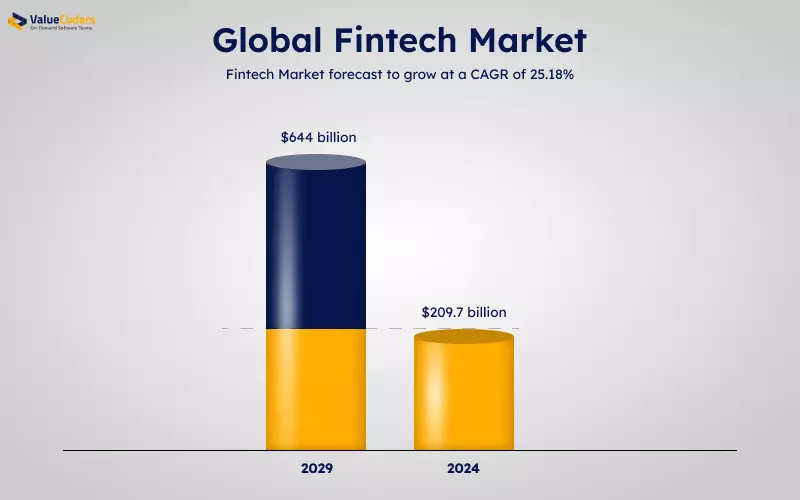

The fintech industry is evolving, and so is its risk. In 2024, the global fintech market is expected to be valued $209.7 billion. The number has surged, and by 2029, it is expected to reach $644 billion, growing at a CAGR of 25.18%.

Advancing automation tech and an ever-growing array of online and app-based services are perhaps the most important factors driving fintech’s growth.

If you’re building a fintech solution, knowing the latest technology, compliance, and scalable infrastructure is the least you can expect from an in-house team. It’s best to collaborate with a reliable fintech outsourcing partner.

With the right Fintech outsourcing services, you get:

- Compliance-first product engineering

- Fintech-specialized tech expertise

- Legacy-to-cloud modernization

- Faster, secure product rollouts

Common Challenges in the Fintech Industry

The fintech industry is growing, but this growth brings exposure to cyber threats and regulatory concerns. Here are the major fintech growth challenges that in-house teams often struggle to tackle.

1. Fintech Industry is Prone to Cyber Attacks

Fintech platforms are at higher risk of cyberattacks. Especially firms with a lack of team or resources are at major risk, because,

- No 24/7 threat detection

- Insecure development practices

- Missing zero-trust architecture

A strong fintech outsourcing partner brings security-first development, regular audits, and threat prevention baked into every layer of your product.

2. Lack of Regulatory Compliance Integration

With constantly evolving frameworks like GDPR, PCI DSS, and RBI guidelines, staying compliant is necessary. Internal teams often struggle to keep up.

- Reactive compliance approach

- Limited regulatory expertise

- Manual policy updates

An experienced partner ensures compliance is part of your app’s foundation, not just a box to check at the end.

Access pre-vetted fintech experts within days. We deploy domain-ready talent that integrates seamlessly with your team.

3. Outdated Systems Make Innovation, Integration, and Growth Harder

Outdated systems are cumbersome to innovate, integrate, or scale. Transitioning to modern fintech stacks without an expert is more difficult.

- Rigid, monolithic architecture

- Cloud migration challenges

- Poor API readiness

A strategic outsourcing partner manages the entire transformation, modernizing without downtime or data loss.

4. Talent Shortage in Fintech Expertise is a Red Flag

Fintech demands highly niche skills across AI, blockchain, cybersecurity, and DevSecOps. Finding and retaining this talent in-house is expensive and slow.

- Short supply of domain experts

- Hiring for every role isn’t viable

- Limited exposure to fintech trends

An IT Outsourcing Services provider gives you on-demand access to skilled professionals, without long hiring cycles or overhead.

5. Fintech Industry is in Continous Stress to Innovate

There’s immense pressure to deliver new fintech products which is faster, cheaper, and more secure. But speed without stability often leads to customer trust issues.

- Increase the risk of bugs and downtime

- Skipped validation steps

- Innovation without control

With the right partner, you can move fast and still play safe, releasing innovation that’s stable, secure, and audit-ready.

Leverage our deep fintech engineering expertise to build future-proof solutions.

Why Is Data Security Critical When Outsourcing Fintech Services?

In fintech, your most valuable asset isn’t just your product—it’s the trust customers place in you to protect their sensitive data. Outsourcing development means giving third-party teams access to critical financial information, making data security a non-negotiable priority.

Without strong security measures from day one, the risks include:

- Regulatory penalties from frameworks like GDPR, PCI DSS, and RBI

- Customer trust erosion from data breaches or misuse

- Financial losses due to fraud or operational downtime

A reliable fintech outsourcing partner will embed security-first architecture, conduct regular penetration testing, and implement encryption, secure APIs, and zero-trust protocols at every stage, ensuring compliance while safeguarding your brand reputation.

Steps to Evaluate a Fintech Outsourcing Partner

Choosing a fintеch outsourcing partnеr savеs monеy and hеlps you mееt dеadlinеs. You nееd a smart, rеliablе tеam that undеrstands financе, builds sеcurе systеms, and follows all thе rulеs from thе start.

Here are the key factors fintech firms should consider when choosing an outsourcing partner.

Built-In Security from Day One

Security should be integrated into the software architecture, not added later as an afterthought. A capable partner will ensure:

- Secure software architecture

- Real-time threat detection, encryption, and audits

Compliance-First Development

Navigating financial regulations shouldn’t slow down innovation. A reliable outsourcing partner builds with compliance in mind from day one.

- Expertise in regulatory mapping and automated compliance reporting

- Secure data handling, audit trails, and data residency controls

Scalable Custom Software Development

A strategic fintech partner supports you in your growth, without making you start over. Scalable, modular systems allow for rapid evolution as needs change.

- Modular fintech apps (wallets, payment systems, KYC, etc.)

- API-first design for future growth and integrations

Also Read: Leading Fintech Software Development Companies for 2025

Access to Elite Fintech Tech Talent

Fintech innovation requires access to niche skills, fast. Partnering with one of the Top Software Outsourcing Companies gives you flexible access to experienced specialists.

- Blockchain, AI, DevSecOps, and cloud experts on demand

- Flexible engagement: Dedicated teams or staff augmentation

Agile Execution + Post-Launch Support

A partner’s value isn’t just in delivery, it’s in iteration, support, and growth. They should help you launch faster and optimize continuously.

- Faster go-to-market with agile sprints

- Long-term optimization, support & compliance tracking

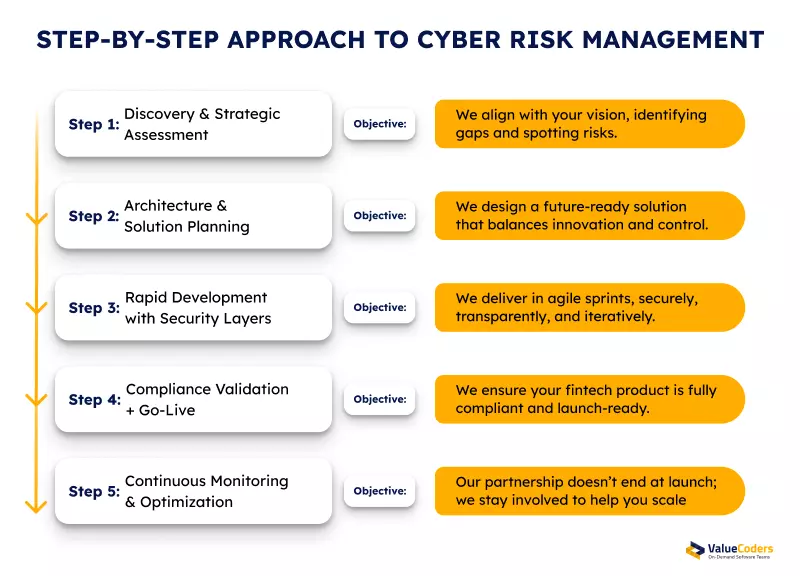

The ValueCoders Partnering Process: How It Works

How ValueCoders Works to Strengthen Your Cybersecurity

At ValueCoders, we combine deep fintech expertise with our Custom Software Development Service. From idea to scale, here’s how we help you build and manage robust fintech products.

Step 1: Discovery & Strategic Assessment

We start by aligning with your vision, identifying gaps, and spotting risks.

- Undеrstand your businеss goals and markеt challеngеs

- Evaluatе еxisting systеms, tеch gaps, and intеgration nееd

- Highlight compliancе, scalability, and sеcurity considеrations

Step 2: Architecture & Solution Planning

Next, we design a future-ready solution that balances innovation and control.

- Finalize tech stack and system architecture

- Build a scalability, security, and performance-ready solution

- Map out compliance requirements and data flow logic

Step 3: Rapid Development with Security Layers

We deliver in agile sprints, securely, transparently, and iteratively.

- Modular development with full test coverage

- Built-in security layers and code audit checkpoints

- Clear progress tracking and regular sprint reviews

From lending platforms to payment gateways, we’ve helped global fintech leaders launch, scale, and stay audit-ready.

Step 4: Compliance Validation + Go-Live

We ensure your fintech product is fully compliant and launch-ready.

- Final security testing and regulatory validation

- User testing to ensure everything works smoothly

- Safe, smooth launch with no last-minute issues

Step 5: Continuous Monitoring & Optimization

We monitor our clients’ side even after the launch to ensure it scales.

- Ongoing performance tuning and 24/7 security monitoring

- Compliance updates aligned with evolving regulations

- Feature enhancements and product evolution support

Also Read: Protecting Business in Digital Age with Cybersecurity in Software Development

Navigate Fintech Complexity with a Strategic Partner ValueCoders

Every decision from tech and talent to timelines needs to balance speed, security, and compliance. Without the right partner, even the best ideas can hit roadblocks or create risk.

That’s where ValueCoders comes in. As a FinTech Software Development Company, we give you instant access to top-tier talent in AI, blockchain, DevSecOps, and cloud. Whether you’re building something new or upgrading old systems, our experts integrate fast, understand your industry, and help you move forward without ever compromising on quality.