As we are stepping into the year 2024, we are undoubtedly on the verge of technological advancement that has taken over the world. Blockchain being the pioneer in innovation, transcended the technological paradigm shift that has moved certain industries for the better.

Do You Know?

– In a survey, 56% of associates said that they recognize the importance of Blockchain technologies. (PwC, 2020)

– Worldwide, the financial services market is predicted to reach $26.5 trillion by 2024. (The Business Research Company)

Image Source: Finances Online

An amalgamation of FinTech and Blockchain has been the most talked-about tech mix that has pushed the boundaries of excellence for the FinTech industry.

Blockchain adoption in their existing business tech stack has been adopted by certain industries varying from FinTech to Supply Chain to Education and much more. The most promising FinTech and Blockchain evolution have improvised security through faster transaction rates and reduced costs.

Why Should FinTech Industry Adopt Blockchain Technology?

Challenges faced by the FinTech industry have been resolved through the transmitting power of Blockchain. A powerhouse mix of FinTech and Blockchain has helped in removing Intermediaries, reduced costs, data integrity, asset creation, and distribution are some of the key benefits that Blockchain beholds along with data privacy and authentication.

Tech Giant Accenture estimates that the adoption of Blockchain technology in the clearing and settlement sectors of banking could save the biggest investment bank close to $10 billion. A popular application of Blockchain has been seen through the Australian Securities Exchange that has already executed a project to transfer its post-trade clearing and settlement through a Blockchain system.

Additionally, blockchain Decentralized Marketplace applications have become another significant use case in the FinTech industry. These marketplaces allow for peer-to-peer transactions, reducing reliance on centralized financial intermediaries and offering greater transparency and security for both parties.

Since we are stepping towards a more digitized world where digital payments, e-wallets hold a major space and pace, there have been startups that are on the lines of FinTech and Blockchain without compromising on the eccentric value of both the technologies in practice. Thus, there is a need for financial companies, startups and banking institutions to up their game by integrating Blockchain in their existing business ecosystem to leverage the benefits of this ever-evolving technology.

Well, if you are looking forward to adopting Blockchain technology to focus on FinTech Application Development, get connected with the best Blockchain Development Company In India, doing you will get leading Blockchain Development Services.

Get free consultation and let us know your project idea to turn it into an amazing digital product.

How Blockchain Transformed FinTech?

People are now more informed and aware of the latest technologies available in the market. Blockchain has transformed FinTech by making it secure, transparent, cost-effective for all parties involved. It is no longer just a new technology but an established one that can be used to bring about positive changes across industries and sectors such as Healthcare, Education, etc.

Moreover, Blockchain has evolved the financial sector, ultimately helped in performing online functions from home, ignoring the hassle of going out or waiting in queues at ATMs for hours.

Blockchain helped eliminate fraud risks as well as cut down costs for all parties involved, which includes banks, customers, and merchants. Blockchain-enabled new methods of payment, including cryptocurrency or virtual currency such as Bitcoins, are making transactions more secure and simpler.

According to the survey on the financial services sector and FinTech conducted by PWC, more than 77% of the financial services industry planned on adopting Blockchain by 2020. The transition has been tremendous as banking, and financial institution makes 1/3rd of the entire institutions around the world, and it has been observed that Blockchain will be incorporated by banking and financial operations for improved features and much more.

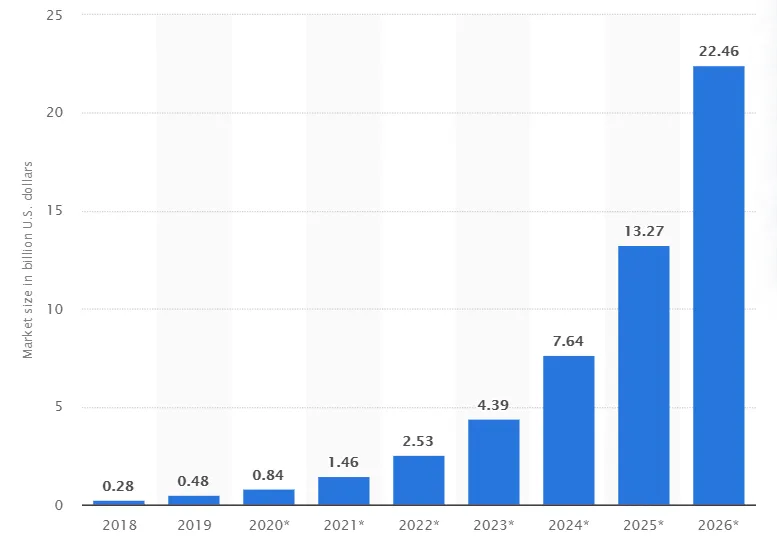

As per Statista, the market size for Blockchain solutions for the banking system and financial institutions was estimated at $0.84 in 2020 and is expected to develop further in the next years, reaching a market size of approx $22.5 billion in 2026.

Image Source: Statista

Let’s move further and know how Blockchain technology is helping the FinTech industry.

5 Ways Blockchain Technology Revolutionizing FinTech Industry

Blockchain is a technology that has revolutionized the FinTech industry by bringing banking and finance to the fingertips of users. Blockchain not only makes financial transactions more secure but also helps in reducing costs for banks and other financial institutions involved.

If you also want to grow your FinTech business, then think of availing FinTech Development Services from the top-rated Blockchain Wallet App Development Company. By doing you, you will be able to form an excellent FinTech application integrating trending technology like Blockchain.

Moreover, here view the five ways through which Blockchain is transforming the FinTech sector:

1. Blockchain-Based Smart Contracts

A smart contract is a digital agreement that executes the terms of an agreement automatically. Blockchain technology helps in creating and managing these smart contracts, which are more secure than traditional paper agreements, as they do not require physical signatures from all parties involved.

2. Lower Cost and Time Saving

In Blockchain, there is no need for a middleman or third party to perform transactions. This helps in reducing transaction costs and makes the process faster as well. The parties involved can directly interact with each other to perform financial operations without any delay, which reduces time delays associated with traditional banking methods.

3. Eliminating Fraud Risks

Image Source: FEI Daily

Blockchain technology uses cryptography to keep all financial and non-financial data secure, making it difficult for cybercriminals to hack into such platforms. In addition, Blockchain offers a decentralized platform, which makes it very difficult for hackers to alter details without being detected.

4. Easier Cross-Border Transactions

Blockchain helps in making international payment easier and faster by removing barriers such as multiple currencies, time delays for value transfer, foreign exchange fees, etc.

5. Increased Transparency & Accessibility

With Blockchain technology, the process of auditing tends to be more efficient and cost-effective due to its distributed ledger system that holds a single version of records. Moreover, banks are increasingly using Blockchain platforms that enable people around the world. This helps in improving financial inclusion and helping people to gain access to banking services even in remote areas.

Get free consultation and let us know your project idea to turn it into an amazing digital product.

Blockchain Technology Use Cases In FinTech and Banking Sector

Image Source: Ivan on Tech Academy

Blockchain is being used by FinTech industries across the world to make secure transactions and ensure transparency in all financial matters. Let’s discuss some use-cases for FinTech Industries adopting Blockchain that can revolutionize the industry for the better:

Blockchain For KYC (Know Your Customer)

Blockchain helps in sharing information quickly, securely, and transparently with banks and customers without the need of a third party or any intermediaries, which ensures that all parties involved are on board regarding data confidentiality. This kind of transparency also builds trust among stakeholders as they have access to all relevant details in real-time.

Blockchain For Payments

Blockchain has transformed financial transactions by making them faster, cost-effective and secures using cryptocurrencies or virtual currencies such as Bitcoins. It uses a cryptocurrency wallet that helps in transacting money from one party to another without the need of any sort of intermediaries, including banks. One can also use Blockchain technology for peer-to-peer transactions.

Blockchain For Digital Identity

Cyber-security and fraudulent scam cases have been registered over time, with the increase in malicious transactions that have taken over the headlines. The issue of misusing and impersonating someone else’s identity has been an issue that has generated a lot of ruckuses for authenticating and streamlining the transaction flow.

But now, Blockchain is helping in creating an electronic version of a person’s physical ID, which can be used to store data securely and share it with relevant stakeholders on the Blockchain network anytime. It also assures that only entitled people have access to such information, preventing any sort of security breach or hacking attempts.

Blockchain For Regulatory Compliance and Audits

Worldwide, regulatory affairs outsourcing market size was estimated at $6.3 billion in 2020 and is anticipated to grow at a compound annual growth rate (CAGR) of 11.9% from 2021 to 2028 year. (Grand View Research)

Regulatory compliance is one of the major pain points for financial institutions that are dealing with a large number of data and transactions on a daily basis. Blockchain helps businesses in identifying potential risks, frauds, money laundering activities as well as tax evasion attempts, enabling banks to take required actions against them.

For example, EY has launched its EY Blockchain Analyzer. This product encompasses a set of Blockchain audit technologies to bring a review of cryptocurrency transactions to a new level.

Blockchain For Trading

Trading finance and online trading have been among the industries that involve a lot of paperwork and bureaucracies which go in multiple circles, from brokers to the stock exchange for the settlement of funds. The evolution of Blockchain has certainly come along as a breather to exempt traders from burdensome checks of counterparties and optimize the whole lifecycle of a trade.

Using a Blockchain, companies can record and settle trades between two parties in a secure, safe and transparent manner. It eliminates any sort of need for intermediaries or brokers and helps reduce costs as well as time is taken to complete the process. Blockchain also ensures that all transactions are recorded accurately, keeping records tamper-proof thereby, helping prevent frauds.

For instance, some popular Blockchain-powered trading platforms are Overstock.com, Nasdaq, Bitfinex, BitShares, and Kraken. You can also develop a leading platform for your industry, and for this, all you need to do is get in touch with the top-notch Blockchain App Development Company.

Blockchain For Crowdfunding

Crowdfunding is one of the most innovative means for entrepreneurs and startups to raise funds from many people with limited resources or financial backing. It helps in creating an ecosystem where small businesses can benefit by getting funding directly from investors ensuring transparency, reducing middlemen involvement, costs, and time is taken for the whole process.

Get free consultation and let us know your project idea to turn it into an amazing digital product.

Popular FinTech Companies Using Blockchain Technology

Several popular FinTech companies use Blockchain technology to power their FinTech services. Some of them are as follows:

DataRoot Labs: It provides many financial services such as insurance and lending solutions.

BitFury: This is one of the largest producers of bitcoin servers that has been using Blockchain technology since its inception. The company helps implement and maintain Blockchain infrastructure for various enterprises, government agencies, banks, etc.

BTCJam: It is a peer-to-peer Bitcoin Lending Site that uses Blockchain technology for secure transactions.

BitPagos: It helps merchants accept and process credit cards with zero chargeback risk, transaction fees, or currency exchange loss by using Blockchain technology in merchant payment processing.

CoinBase: The company allows users to buy, sell and store Bitcoins securely.

Xapo: It provides a Bitcoin wallet and debit card, which is used to spend Bitcoins at millions of merchants all over the world. It also lets you buy Bitcoins instantly with your credit card or cash deposit in thousands of ATMs around the USA.

Related Post: 9 Industries Where Blockchain Can Trigger Breathtaking Transformations

Conclusion

FinTech is the financial technology and innovation for banks, global corporations, small businesses, entrepreneurs. Blockchain has transformed it to make transactions cheaper and more secure with increased transparency. Implementing Blockchain in the FinTech industry will help you eliminate fraud risks by providing a decentralized system that can be trusted by all parties involved (customers, suppliers).

Moreover, the potential use cases of this revolutionary technology have limitless possibilities! So if you are also looking forward to adopting Blockchain technology in your FinTech business process, hire Blockchain developers working in the top-rate Blockchain app development company (ValueCoders).