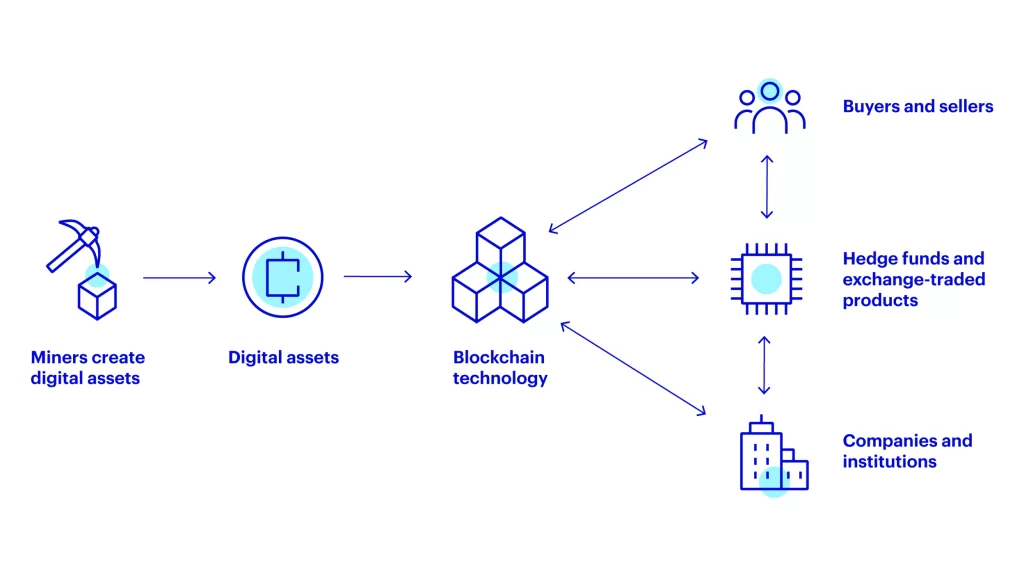

The digital asset industry is booming and is only going to continue to grow in the coming years. As businesses look for ways to tap into this market, blockchain technology is proving to be a key solution for digital assets.

They are becoming more and more popular due to the rise of cryptocurrencies, stablecoins, and non-fungible tokens. Enterprises that engage in digital assets have a significant opportunity to deliver meaningful value to their customers with new service and business models.

However, many businesses still don’t know how to take advantage of digital assets and blockchain technology.

It’s important to understand digital assets in blockchain because enterprises take it as an alternative investment, capital raising tool, and transactional medium (when used as money).

If you’re not sure why you should care about digital assets in blockchain, read on as we discuss how digital assets in blockchain could help your enterprise.

In this article, we’ll explore how digital assets use in enterprise blockchain applications.

Digital Assets: A Brief Along With Examples

Digital assets in blockchain, called crypto tokens or crypto assets, are a special type of assets that usually exist on top of one or more blockchains, the most well-known being the bitcoin blockchain.

There are a number of different ways to create digital assets. One common way is to use blockchain app development services. In the blockchain, a digital asset is called a “token.” Tokens can be used to represent anything that has value, including money, goods, or services.

They can also be used to represent other tokens. This creates a system in which digital assets can be traded and used to represent value.

Digital assets offer a number of advantages over traditional assets. They are easier to store and transport, and they can be divided into smaller units without losing value. They also have the potential to provide more security and privacy than traditional assets.

Also Read: Cloud Computing Vs. Blockchain Technology: Which Is Right For Your Business?

Digital assets are becoming increasingly popular, and their use is expected to continue to grow in the future. They offer a number of advantages over traditional assets and have the potential to revolutionize the way we do business.

Some common examples of Digital Assets include:

– Cryptocurrencies, such as Bitcoin and Ethereum

– Loyalty points, such as airline miles or hotel points

– Blockchain-based tokens, such as those used in the gaming industry

– Digital media, such as music, movies, and books

– Intellectual property, such as patents and trademarks.

Embrace the Future of Enterprise Growth and Innovation.

Different Types of Digital Assets For Blockchain

There are many different types of digital assets in the blockchain. The most common type of digital asset is a cryptocurrency, which has to purchase goods and services or trade for other assets.

Other types of digital assets include tokens, digital contracts, and digital identities. Each type of digital asset has its own unique characteristics and use in different ways.

Cryptocurrencies are digital assets that use cryptography to secure their transactions and to control the creation of new units. Decentralized Cryptocurrencies are not subject to government or financial institution control.

Bitcoin, the first and most well-known cryptocurrency, was created in 2009. Ethereum, another popular cryptocurrency, was created in 2015. Cryptocurrencies often trade on decentralized exchanges and can also be used to purchase goods and services.

Tokens are digital assets that represent a fungible or non-fungible asset. Tokens represent different things, such as digital currency, loyalty points, or access rights. Hire NFT marketplace developers who are well-versed in these technologies.

Ethereum is the most well-known platform for creating and issuing tokens. Tokens trade on decentralized exchanges or used to purchase goods and services.

Digital contracts are digital assets that encode agreements between parties. Digital contracts represent anything from simple agreements, such as a loan agreement, to more complex ones, such as a smart contract.

Ethereum is the most well-known platform for creating and issuing digital contracts.

Moreover, Digital identities are digital assets that represent a person, organization, or thing. Digital identities can be used to log in to online accounts, sign documents, or access services.

Here also, Ethereum is the most well-known platform for creating and issuing digital identities. Digital identities can be stored on a blockchain or off-chain.

Also Read: Smart Contracts: Building Secure And Efficient Automated Systems With Blockchain

Ways How Digital Assets Can Be Used In Blockchain Apps

-> One of the most obvious ways to use digital assets in a business setting is to store them on a blockchain. This can provide security and transparency for companies that want to track their digital assets. Blockchain technology creates digital asset wallets, which allow users to store and manage their digital assets securely.

-> Another way to use digital assets in the enterprise is by using them as payment tokens. For example, a business could use digital assets to pay its suppliers or employees. This can help reduce the cost of transactions and make the payment process more efficient.

-> Digital assets can also be used to create blockchain decentralized marketplace identities. This can provide a more secure and efficient way for companies to manage customer information. DeFi Development Services enable these digital identities to be incorporated into decentralized applications (dApps), offering users control over their personal data.

-> Finally, businesses can use digital assets to create their own tokens. These tokens can be used to represent anything from loyalty points to shares in the company. By creating their own tokens, businesses can raise capital, incentivize customer behavior, or create a new form of digital currency.

Elevate Efficiency and Security in Your Enterprise Operations Today.

New Business Opportunities Around Digital Assets

Digital assets are becoming more and more popular, as blockchain technology continues to evolve. There are a number of business opportunities around digital assets, which include:

Trading platforms

Digital assets trade on specialized platforms, similar to traditional stock exchanges.

Payment processors

Digital assets pay for goods and services, just like traditional currency.

Investment vehicles

Digital assets can invest in a number of different ways, including through blockchain-based startups and Initial Coin Offerings (ICOs).

Decentralized applications

Digital assets can be used to power blockchain-based applications, which are becoming more and more popular.

Each of these opportunities presents a unique set of challenges and opportunities. For example, trading platforms need to ensure that they are able to handle the high volume of transactions, while payment processors need to be able to quickly and easily process payments.

Meanwhile, blockchain-based startups need to be able to demonstrate the value of their digital assets in order to attract investors.

Few Security Risks And Compliance Requirements

Like any new technology, there are security risks and compliance requirements to consider before implementing a blockchain solution.

The blockchain is a distributed database, meaning that data is stored across a network of computers rather than a single server. This makes it difficult for hackers to gain access to the data, as they would need to hack into all of the computers on the network. However, blockchain is not infallible.

In January 2018, a cryptocurrency mining company called NiceHash was hacked, resulting in the loss of 4,700 Bitcoin, worth around $60 million at the time.

Businesses that are looking to use blockchain for digital assets need to ensure that they have appropriate security measures in place to protect their investment. These may include firewalls, anti-virus software, and password protection.

In addition, businesses need to be aware of compliance requirements specific to the blockchain. For example, in some jurisdictions, businesses need to register their blockchain solution with the relevant authorities. Failure to do so may result in fines or imprisonment.

Businesses should also ensure that they have a good understanding of blockchain technology before implementing it. Blockchain is a complex technology, and there is a lot of misinformation out there. It’s important to get advice from an expert before making any decisions.

Navigate Blockchain's Potential with Confidence and Expert Guidance.

Top Reasons Why Enterprises Should Adopt Blockchain For Digital Assets

- Security: Blockchain provides a high level of security for digital assets. The distributed ledger technology ensures that all transactions are recorded and verified, making it virtually impossible for hackers to gain access to sensitive information.

- Transparency: All transactions on the blockchain are publicly visible, which helps create greater transparency and trust among users. This can be particularly useful for businesses that handle digital assets with multiple parties involved.

- Efficiency: The blockchain is a distributed network, which means that there is no central point of control. This leads to faster and more efficient transactions with minimal delays.

- Cost-Effectiveness: Blockchain technology is cost-effective and can help businesses save on transaction fees. In addition, the elimination of intermediaries can also lead to reduced costs overall.

- Scalability: The blockchain is capable of handling high volumes of transactions without any lag or delay. This makes it well-suited for businesses that are looking to scale up their digital asset operations.

What Options Are There For Entering The Digital Assets Business?

There are a few different ways to get into the digital assets business. It depends on how quickly your institution wants to offer these services, what type of services you want to offer, and your appetite for risk and innovation.

Firms can use standard outsourcing arrangements and white-label services or develop their own solutions, incorporating off-the-shelf software components as needed. Each option has its own advantages and disadvantages, so it’s important to weigh all the factors before making a decision.

The Future of Digital Assets in Blockchain

Digital assets in blockchain are digital representations of value. It can be stored, traded, and managed on a blockchain platform. Blockchain is a distributed database that allows for secure, transparent, and tamper-proof transactions. This makes it an ideal technology for managing digital assets.

The future of digital assets in blockchain looks very promising. With the increasing adoption of blockchain technology, more and more businesses are starting to use blockchain to manage their digital assets. This is because blockchain offers a secure, transparent, and tamper-proof way to store and trade digital assets.

As the adoption of blockchain technology increases, we can expect to see more businesses using blockchain to manage their digital assets. This will result in more efficient and secure digital asset management services. In addition, the use of blockchain for digital assets will help to reduce fraudulent activities and increase transparency in the digital asset market.

Overall, the future of digital assets in blockchain looks very promising. With the increasing adoption of blockchain technology, we can expect to see more businesses using blockchain to manage their digital assets. This will result in more efficient and secure Digital Asset Management. In addition, the use of blockchain for digital assets will help to reduce fraudulent activities and increase transparency in the digital asset market.

It’s no secret that digital assets are the lifeblood of blockchain technology, but are we in danger of losing our grip on them?

Also Read: Top 7 Banking and Financial Software Companies, Enterprises Must Consult In 2025

Here Are Some Important Things To Know About Digital Asset Management (Dam) And Blockchain

-

Digital Assets go beyond media files

Think of digital assets as anything that lives in a computer or other device and has value to an organization—from word processing documents to medical images, financial data, or design specs. That said, blockchain isn’t just for storing large amounts of data—it can also handle metadata for any type of file.

-

Blockchain isn’t just about transactions

Most people think of blockchain when they hear bitcoin, but bitcoin is just one application on top of blockchain technology that enables transactions between parties without needing an intermediary like a bank or government body. And blockchain doesn’t have to involve money—other applications, including blockchain for supply chain, smart contracts, and identity verification, are revolutionizing industries by enhancing transparency, security, and efficiency.

-

Blockchain isn’t blockchain without distributed ledgers

The term blockchain refers to a chain of blocks that contain information related to digital assets. Each block contains information about who owns what when each transaction occurred, and whether it was successful or not (hence why it needs consensus).

But there are different types of blockchains with different properties depending on their use case including public vs private blockchains, permissioned vs permissionless blockchains, federated vs decentralized blockchains.

-

Blockchain requires a network

Blockchain requires multiple nodes to reach a consensus on new transactions before adding them to its ledger. It acts as a series of trusted nodes working together instead of trusting one central entity such as a bank or clearinghouse.

Nodes can either run on dedicated hardware devices called blockchain infrastructure solutions or software installed locally by individual users. When using blockchain for digital assets, organizations often set up nodes using infrastructure solutions from vendors such as IBM and Oracle.

-

Blockchain is still evolving

Blockchain technology is still in its infancy, which means it will take time for enterprises to figure out how best to leverage blockchain for digital assets. However, blockchain offers many benefits over legacy systems, such as more secure transactions and reduced costs due to automation.

While some experts say blockchain could save banks $20 billion per year through improved efficiency, others say it will take at least five years before enterprises adopt blockchain at scale.

This uncertainty makes sense given that blockchain itself is still evolving – remember, Bitcoin first launched back in 2009! – so, businesses will need time to experiment with different use cases and figure out where blockchain fits into their broader strategy.

-

Blockchain can help solve real problems

As blockchain technology evolves, it will become a viable solution for digital assets in areas such as intellectual property rights management, patient records, and even voting.

Companies are already exploring ways to apply blockchain to digital assets, including:

- International Business Machines Corp. is building a platform for digital rights management.

- Amazon Web Services Inc. is developing a cloud service for storing and tracking digital assets. · EY recently conducted a proof of concept that used blockchain to verify an insurance claim.

Unlock Efficiency, Security, and Innovation for Your Enterprise.

Conclusion

Digital assets offer a number of benefits for businesses that want to use blockchain technology. They store data securely, pay employees and suppliers, and power dApps. As digital asset adoption continues to grow, we can expect to see even more businesses taking advantage of them.

Hence, enterprises should adopt blockchain for digital assets in 2022-23 to take advantage of the many new business opportunities around this technology.

However, with more innovations in this space, we at ValueCoders (a leading Blockchain Software Development Company) anticipate these issues to resolve in the defined timeline. So, enterprises should continue to explore how they can use blockchain for digital assets to streamline their operations and provide better experiences for their customers.