In the emerging digital world, safeguarding digital transactions against fraud is paramount for individuals, businesses, and financial institutions.

According to GlobalData Report, the digital payments market will be at $2,476.8 trillion in 2023 and is predicted to grow at a CAGR of 14.3% over the forecast period.

With the rise in online commerce and the proliferation of digital payment methods, the opportunities for fraudsters have also grown.

To combat this, data analytics has emerged as a powerful tool in real-time fraud detection, offering a proactive approach to identify and prevent fraudulent activities.

Let us learn more about real-time fraud detection and explore how data analytics shapes digital transactions’ security landscape.

About Real-time Fraud Detection

Real-time fraud detection refers to the continuous monitoring and analysis of digital transaction data to identify and prevent fraudulent activities as they occur.

It uses advanced data analytics techniques to detect anomalies, suspicious patterns, and unauthorized access in real-time.

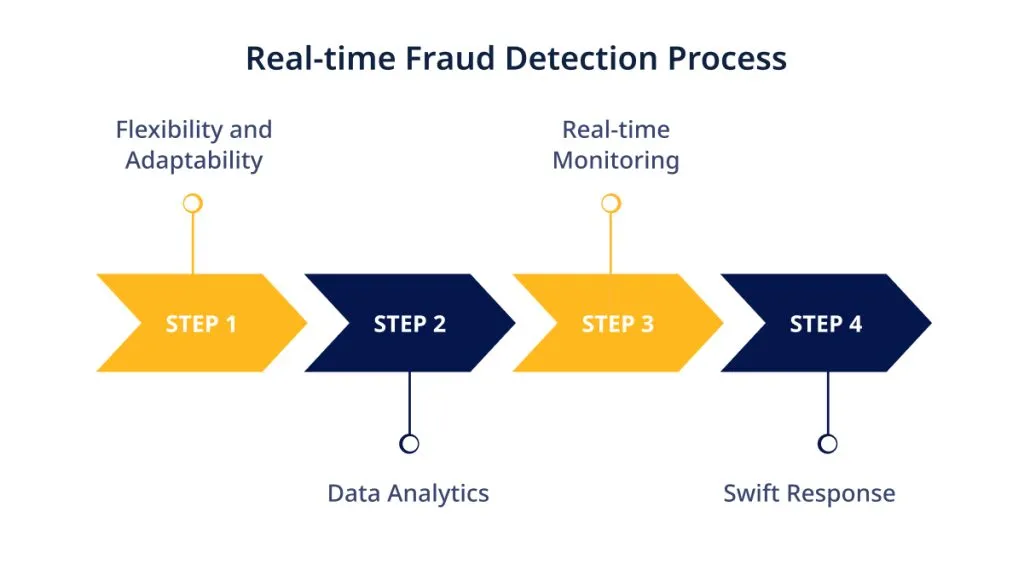

In fraud detection, data analytics leverages:

- Historical transaction data

- Machine learning algorithms

- Real-time monitoring

to identify potentially fraudulent activities.

Safeguarding digital transactions holds immense importance in today’s interconnected world. As technology advances, digital transactions have become integral to our daily lives.

Here’s why fraud Detection in Digital Transactions is crucial, along with some key points:

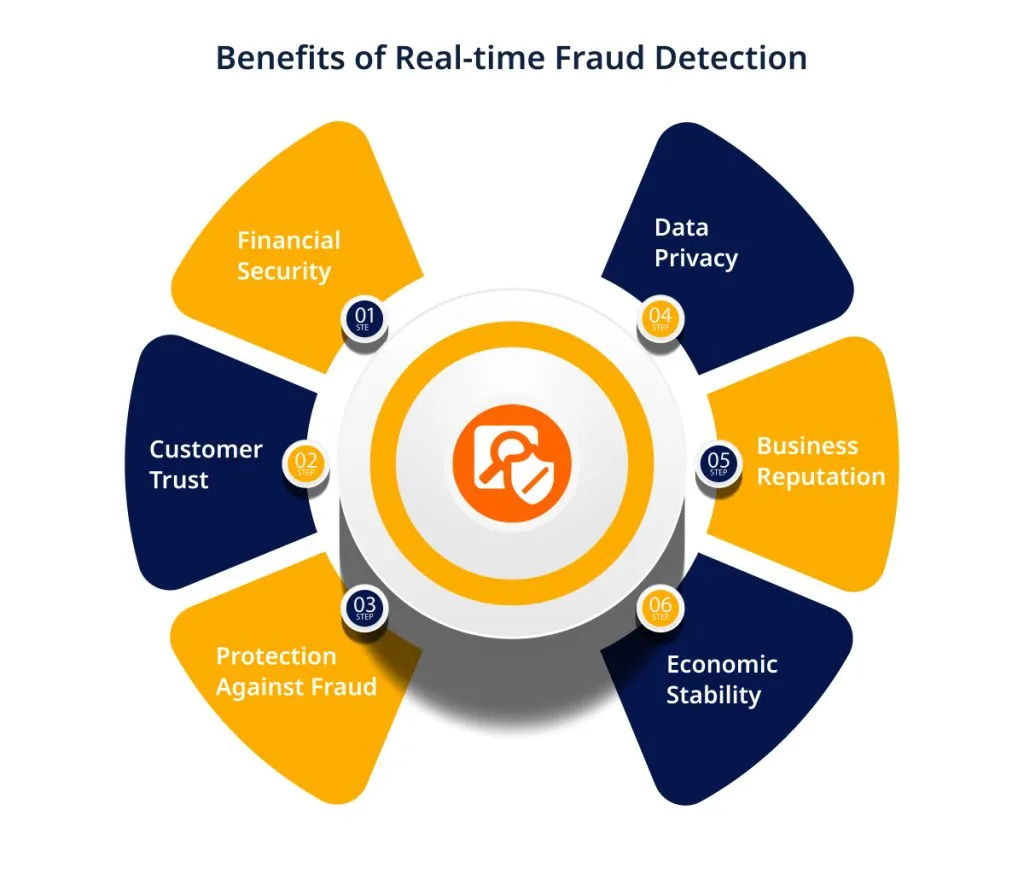

1. Financial Security: Digital transactions often involve the transfer of money, making them attractive targets for cybercriminals. Ensuring the security of these transactions is paramount to prevent financial losses.

2. Customer Trust: When individuals and businesses know their digital transactions are secure, they are more likely to trust online payment systems and e-commerce platforms. This trust fosters a healthy digital economy.

3. Protection Against Fraud: Safeguarding digital transactions helps in the early detection and prevention of fraud, reducing the financial impact on consumers and businesses.

4. Data Privacy: Digital transactions often involve exchanging sensitive information, such as personal and financial data. Protecting this data is essential to maintain individual privacy and comply with data protection regulations.

5. Business Reputation: Companies that prioritize transaction security build a positive reputation. Conversely, security breaches can lead to a loss of trust, customer attrition, and damage to a brand’s image.

6. Economic Stability: The stability of financial systems relies on secure digital transactions. Preventing fraud and cyberattacks is vital to maintaining a region’s or country’s overall economic health.

7. Global Commerce: International trade and cross-border transactions heavily depend on secure digital payment systems. Safeguarding these transactions facilitates global commerce and economic growth.

Safeguarding digital transactions is not just about protecting financial assets but also about fostering trust, maintaining privacy, and ensuring the stability of our increasingly digitalized world.

Need for Real-time Fraud Detection

The need for real-time fraud detection in digital transactions is a pressing concern in today’s digital landscape.

As technology evolves, so do the tactics of fraudsters, making it essential to have proactive measures in place.

Here’s why real-time fraud detection is crucial, along with key points:

1. Rising Transaction Volumes: With the exponential growth of digital transactions, the sheer volume provides fraudsters with more opportunities to exploit vulnerabilities.

2. Evolving Fraud Techniques: Cybercriminals continually adapt and refine their methods, employing advanced tactics like phishing, identity theft, and account takeover. Real-time detection is necessary to stay ahead of these evolving threats.

3. Financial Impact: Falling victim to fraud can result in substantial financial losses for individuals and businesses alike, emphasizing the need for immediate detection and prevention.

4. Reputational Risks: Fraud incidents tarnish the reputation of businesses and financial institutions. Customer trust is easily eroded, and it can take time to rebuild it after a breach.

5. Regulatory Compliance: Many industries are subject to strict regulatory requirements regarding fraud prevention. Real-time detection helps ensure compliance with these regulations.

6. Operational Efficiency: Timely detection and automated responses to fraud attempts streamline operations, reducing the time and effort required to resolve fraud-related issues.

7. Customer Experience: Real-time fraud detection minimizes disruptions for customers. Legitimate transactions are less likely to be blocked or delayed, enhancing the overall customer experience.

Data Analytics in Fraud Detection

Data analytics plays a pivotal role in fraud detection, providing the means to analyze vast volumes of transaction data and identify patterns that may indicate fraudulent activity.

Predictive analytics in fraud identification has shown an accuracy improvement of 15% compared to previous years.

Here’s a closer look at the significance of data analytics in fraud detection, along with some key points:

Comprehensive Insights: Data analytics enables the examination of diverse data sources, from transaction logs to user behavior patterns, providing a holistic view of potential fraud.

Predictive Power: Through predictive analytics, historical data can be leveraged to forecast potential fraudulent transactions or patterns, allowing for proactive prevention.

Real-time Monitoring: Real-time data analytics allows for immediate detection of anomalies or suspicious activities as they occur, enabling swift action to stop fraud in its tracks.

Machine Learning and AI: Advanced machine learning algorithms and artificial intelligence enhance the accuracy of fraud detection models by identifying subtle deviations and evolving tactics.

Risk Assessment: Data analytics provides a basis for assessing risk associated with transactions or users, helping organizations prioritize their fraud prevention efforts.

Efficiency and Scalability: Automation and data analytics allow for efficient processing of large volumes of data, ensuring scalability as transaction volumes grow.

Reduction of False Positives: By fine-tuning algorithms and incorporating user behavior analysis, data analytics helps reduce false positives, minimizing disruptions for legitimate users.

Real-time Data Acquisition

Real-time data acquisition is a fundamental component of effective fraud detection systems. It involves collecting and processing transaction data as it occurs, allowing for immediate analysis and response.

Here’s a closer look at why real-time data acquisition is essential, along with key points:

Timeliness: Real-time data acquisition ensures that transaction data is captured and processed instantly, enabling immediate fraud detection and prevention.

Immediate Action: Fraudsters can act swiftly, making real-time response crucial for stopping fraudulent transactions in progress and preventing further damage.

Continuous Monitoring: With real-time data acquisition, transactions are continuously monitored, minimizing the window of opportunity for fraudsters.

Data Diversity: Real-time acquisition covers diverse data types, including transaction timestamps, user information, and device details, providing a comprehensive view of each transaction.

Enhanced Accuracy: Real-time data feeds enable fraud detection models to make decisions based on the most up-to-date information, improving accuracy.

Scalability: As transaction volumes grow, real-time data acquisition methods can scale to efficiently handle the increased data flow.

Building Real-time Fraud Detection Models

Building real-time fraud detection models is a critical aspect of fraud prevention. These models are designed to analyze incoming data in real-time to identify and prevent fraudulent transactions as they occur.

Here are some key points regarding the importance of building robust real-time fraud detection models:

Proactive Protection: Real-time models allow for proactive identification and prevention of fraud, reducing potential losses.

Continuous Monitoring: These models continuously analyze data streams, providing round-the-clock protection against evolving fraud tactics.

Feature Selection: Choosing relevant data attributes and engineering new features enhances the model’s accuracy and effectiveness.

Model Training: Machine learning models are trained on historical data to learn patterns and anomalies.

Hybrid Approaches: Hybrid models combining supervised and unsupervised learning have gained popularity, offering a 10% improvement in detection rates. Combining both supervised and unsupervised learning techniques improves detection rates.

Model Deployment: Deploying these models in real-time systems ensures immediate action against suspicious transactions.

Building real-time fraud detection models is a proactive strategy that relies on data analysis, machine learning, and real-time processing to safeguard digital transactions from fraudulent activities.

Real-time Monitoring and Alerting

Real-time monitoring and alerting are vital components of a robust fraud detection system. They ensure that any suspicious activities are promptly identified and appropriate action is taken. Here are key points highlighting their significance:

Immediate Detection: Real-time monitoring allows for instant identification of anomalies or unusual behavior.

Swift Response: Alerts triggered by the monitoring system enable quick actions to stop fraud in progress.

Minimized Losses: Early detection and rapid response help minimize financial losses associated with fraudulent transactions.

Reduced Customer Impact: Real-time systems minimize disruptions for legitimate customers by swiftly addressing fraudulent activities without blocking valid transactions.

Challenges and limitation

Challenges and limitations in real-time fraud detection are essential to acknowledge to understand the complexities and potential areas of improvement.

Here are key points highlighting some of the notable challenges and limitations:

Data Privacy Concerns: Balancing fraud prevention with data privacy regulations presents a continuous challenge.

Scalability Issues: Ensuring real-time systems can handle increasing transaction volumes can be demanding.

Adapting to Evolving Tactics: Fraudsters constantly evolve their tactics, requiring ongoing updates to detection models.

False Positives: Striking the right balance between accurate detection and minimizing false positives is a persistent challenge.

These challenges and limitations underline the dynamic nature of fraud detection and the need for continuous adaptation and innovation.

Future Trends in Real-time Fraud Detection

Future trends in real-time fraud detection point to exciting developments that will shape the fraud prevention landscape. Here are key points highlighting some of the anticipated trends:

Advancements in AI and ML: Improvement in artificial intelligence and machine learning will enhance detection accuracy.

Integration of Blockchain: Blockchain technology holds promise for enhancing transaction security and fraud prevention.

Regulatory Developments: Governments and regulatory bodies will likely play a more active role in shaping fraud detection through new legislation and compliance requirements.

The future of real-time fraud detection is characterized by advanced technologies, innovative strategies, and increased regulatory oversight to stay ahead of evolving threats.

Final Words

In conclusion, real-time fraud detection powered by data analytics is not just necessary in the digital age; it’s a proactive strategy to safeguard digital transactions and protect businesses and individuals from the ever-evolving threat of fraud.

The latest statistics highlight the effectiveness of these systems in reducing fraud rates, mitigating financial losses, and building trust in digital transactions.

Data analytics’ role in securing digital transactions will only become more critical as technology advances.