In the ever-evolving world of finance, a transformative force is rapidly reshaping the landscape – Artificial Intelligence (AI). Unleashing its potential across the financial services sector, AI is orchestrating a revolution like never before, redefining how we manage, invest, and transact.

Embracing this wave of change, financial institutions have experienced an astonishing surge in efficiency, security, and customer satisfaction. Astonishingly, the use of AI in finance has grown by a staggering 68% in 2021 compared to 2020, as revealed by recent industry reports.

In this era of digital disruption, we embark on an enlightening journey to understand how AI for finance has carved a niche in financial services, delving into its applications, benefits, and addressing the inevitable challenges it brings. Welcome to the world where possibilities are limitless and finance meets the future!

Understanding the Impact of AI on Financial Services

The integration of Artificial Intelligence (AI) has bestowed an unparalleled metamorphosis upon the realm of financial services.

Through its intricate algorithms and advanced data analytics, AI used in finance orchestrates a symphony of insights, elevating decision-making precision and propelling operational efficiency to unprecedented heights. Once confined by traditional practices, financial institutions now harness AI’s predictive prowess to forecast market trends with astonishing accuracy.

As AI service for finance industry evolves, it molds a landscape where fraud detection is fortified, customer interactions personalized, and risk management finely tuned. This dynamic shift is not just a technological advancement; it’s a transformative embrace of intelligence that resonates throughout the financial echelons, revolutionizing processes, and redefining success.

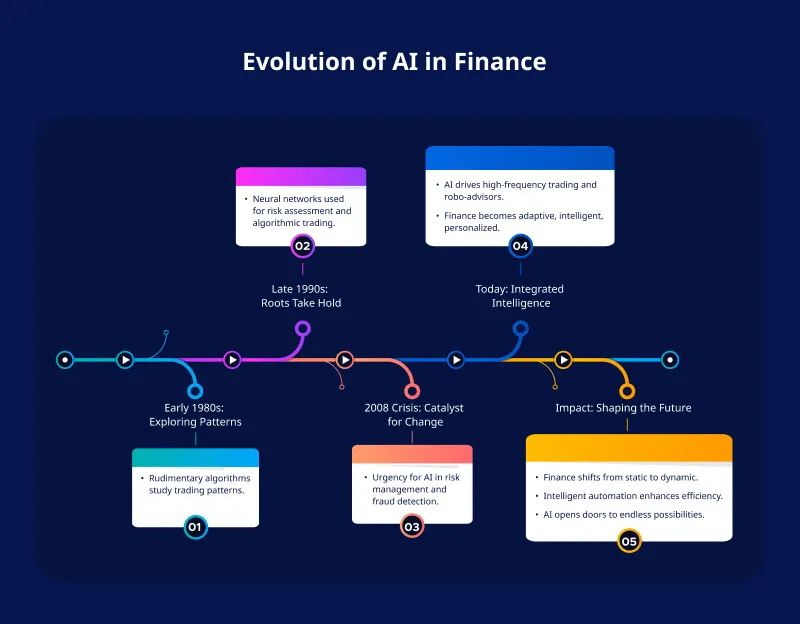

A Brief History of AI in Finance

The intersection of Artificial Intelligence and finance is a captivating tale of innovation that spans decades. The inception of AI for finance can be traced back to the early 1980s when rudimentary algorithms began exploring trading patterns.

However, it wasn’t until the late 1990s that AI’s potential truly took root, with the advent of neural networks for risk assessment and algorithmic trading. In 2008, the financial crisis acted as a catalyst, compelling institutions to seek AI-powered solutions for risk management and fraud detection.

Fast forward to today, AI solutions for finance business has woven itself intricately into the fabric of finance, steering high-frequency trading, powering robo-advisors, and even sculpting personalized financial recommendations. This evolutionary journey underscores AI’s profound impact on financial landscapes, transforming them from static to adaptive and from manual to intelligent, ushering in a new era of possibilities.

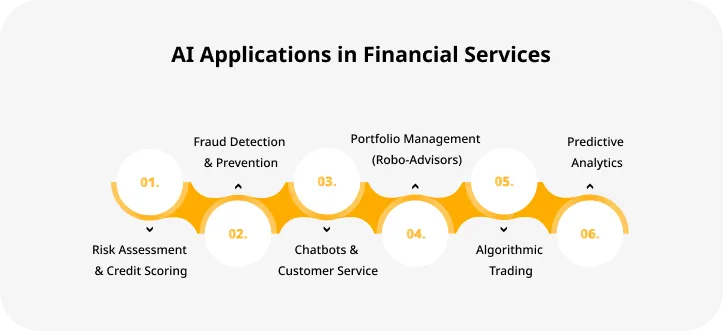

AI Applications in Financial Services

The revolution has brought myriad benefits of AI in finance to institutions and clients alike. It’s reshaped service delivery and management from fraud detection to personalized planning. Let’s delve into AI’s critical roles in finance.

Use Case #1 – Risk Assessment & Credit Scoring:

In the financial world, assessing risk and determining creditworthiness is paramount. Traditional methods often rely on limited data sets and can sometimes be subjective. Enter AI, which offers a more comprehensive and objective approach.

Challenges:

- Limited data sources leading to incomplete risk profiles.

- Historical biases affecting credit decisions.

- Time-consuming manual review processes.

Solution:

AI algorithms can analyze vast amounts of data, from transaction histories to social media activity, to predict creditworthiness more accurately. This not only speeds up the decision-making process but also reduces biases.

Real-world example:

ZestFinance, an AI tool, improved loan approval rates by analyzing thousands of data points, leading to more accurate risk assessments without increasing defaults.

Use Case #2 – Fraud Detection & Prevention:

Financial fraud is a growing concern, with cybercriminals employing sophisticated methods to breach systems.

Challenges:

- Rapidly evolving fraud techniques.

- High false-positive rates leading to blocked legitimate transactions.

- Delayed fraud detection resulting in financial losses.

Solution:

AI can monitor transactions in real-time, identifying unusual patterns or behaviors that might indicate fraudulent activity. It can adapt to new fraud techniques, ensuring robust protection.

Real-world example:

Mastercard uses AI systems to analyze transactions. This has reduced fraudulent transactions by a significant percentage, ensuring both customer trust and financial security.

Use Case #3 – Chatbots & Customer Service:

In today’s digital age, customers expect instant responses to their queries.

Challenges:

- Handling high volumes of customer queries.

- Providing consistent and accurate information.

- Offering personalized customer interactions.

Solution:

AI-driven chatbots can handle multiple queries simultaneously, provide accurate information based on vast data sets, and offer personalized solutions by learning from past interactions.

Real-world example:

Bank of America’s chatbot, Erica, serves millions of customers, answering queries and providing financial advice, leading to enhanced customer satisfaction.

Use Case #4 – Portfolio Management (Robo-Advisors):

Investment strategies are crucial for financial growth, but not everyone has access to expert advice.

Challenges:

- Providing personalized investment advice.

- Adapting to rapidly changing market conditions.

- Handling vast amounts of financial data.

Solution:

AI-driven robo-advisors analyze market conditions, individual preferences, and vast data sets to provide tailored investment strategies.

Real-world example:

Betterment, a popular robo-advisor platform, manages billions in assets, offering personalized investment strategies based on AI-driven insights.

Use Case #5 – Algorithmic Trading:

Introduction:

Trading in the financial markets requires speed, accuracy, and strategy.

Challenges:

- Executing large orders without affecting market prices.

- Adapting to real-time market changes.

- Analyzing vast amounts of market data for decision-making.

Solution:

AI can execute trades based on predefined criteria, analyze real-time data, and adapt strategies instantaneously.

Real-world example:

Two Sigma, a hedge fund, employs AI-driven trading strategies, leading to significant returns and a competitive edge in the market.

Use Case #6 – Predictive Analytics:

Forecasting market trends is essential for making informed investment decisions.

Challenges:

- Analyzing vast and varied data sources.

- Adapting to rapidly changing market conditions.

- Providing timely and actionable insights.

Solution:

AI models can analyze historical and real-time data, offering forecasts that help investors make informed decisions.

Real-world example:

JPMorgan Chase uses AI models to improve its market predictions, leading to better investment strategies and higher returns for its clients.

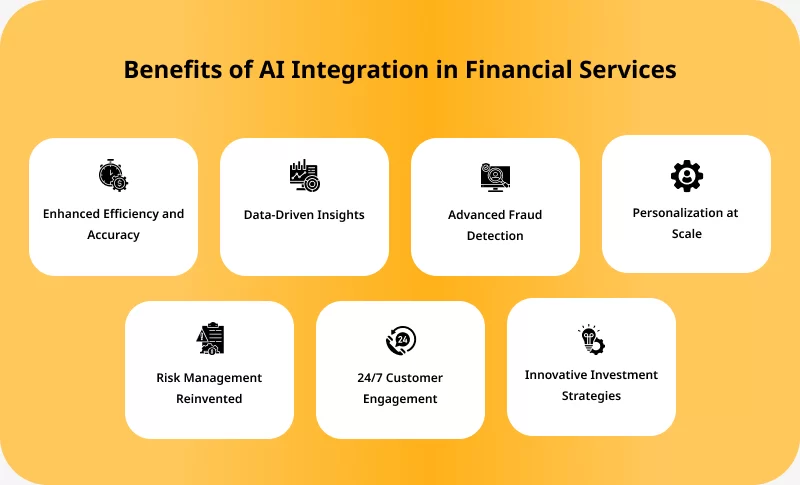

Benefits of AI Integration in Financial Services

Incorporating Artificial Intelligence (AI) into financial services has ignited a transformative journey, bestowing various advantages that redefine the industry landscape.

Enhanced Efficiency and Accuracy: AI’s algorithms process vast datasets at lightning speed, facilitating rapid decision-making with minimal errors. This efficiency not only expedites operational processes but also reduces the risk of human-induced mistakes, leading to cost savings of up to 30%.

Data-Driven Insights: AI’s data analytics capabilities unearth actionable insights from complex data sets, guiding institutions toward more informed strategies. This empowers professionals to anticipate market trends, adjust risk management, and craft personalized financial plans, resulting in heightened profitability and client satisfaction.

Advanced Fraud Detection: AI solution for finance businesses strengthens fraud detection mechanisms by detecting subtle transaction patterns and anomalies. This proactive approach mitigates potential losses, saving institutions an estimated $4.5 billion annually, while bolstering customer trust and loyalty.

Personalization at Scale: AI enables institutions to tailor services to individual preferences and needs. Whether recommending investment options or optimizing financial plans, AI-driven personalization fosters deeper client relationships, reflected in a 35% increase in client retention rates.

Risk Management Reinvented: The benefits of AI in finance include predictive models that offer unparalleled risk assessment, empowering institutions to assess and mitigate risks in real-time. This ensures the preservation of assets, even in volatile markets, and bolsters compliance efforts.

24/7 Customer Engagement: AI-powered chatbots deliver round-the-clock customer support, answering queries and processing transactions promptly. This seamless interaction enhances customer experience and accessibility, contributing to a 40% reduction in customer service costs.

Innovative Investment Strategies: AI-driven algorithms identify investment opportunities and execute trades with precision, adapting to market fluctuations swiftly. This agility fosters robust portfolios and increased returns for both institutions and clients.

The use of AI in finance catalyzes an era of innovation, propelling institutions beyond conventional boundaries and ushering in a future where efficiency, accuracy, and customer-centricity reign supreme.

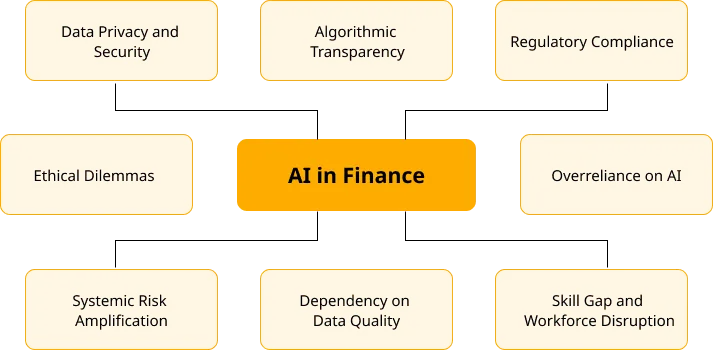

Challenges and Concerns Surrounding AI in Finance

While the integration of Artificial Intelligence (AI) has undeniably revolutionized the financial sector, it is not without its share of intricate challenges and concerns that demand careful consideration.

Data Privacy and Security: The huge amounts of sensitive financial data AI processes raise valid concerns about privacy and security. Safeguarding this information against breaches and unauthorized access remains a paramount challenge, necessitating robust encryption and stringent protocols.

Algorithmic Transparency: As AI’s decision-making becomes more intricate, the opacity of algorithms poses a challenge in comprehending how certain financial judgments are made. Ensuring transparency and interpretability is essential to avoid bias and maintain accountability.

Regulatory Compliance: The dynamic nature of AI for finance often outpaces existing regulations, creating a regulatory lag. Striking a balance between innovation and compliance is crucial to prevent potential legal and ethical pitfalls.

Ethical Dilemmas: AI’s automation can inadvertently lead to ethical dilemmas, such as bias in lending practices or displacing human workers. Striving for fairness, accountability, and the ethical use of AI technology becomes imperative.

Systemic Risk Amplification: AI’s interconnectedness across financial markets could amplify systemic risks, potentially leading to cascading failures. Effective risk management strategies must be devised to mitigate such scenarios.

Dependency on Data Quality: AI’s efficacy relies heavily on the quality and accuracy of data it processes. Poor data quality can lead to skewed insights and erroneous decisions, underscoring the need for comprehensive data governance.

Skills Gap and Workforce Disruption: The advent of AI solutions for finance business could shift required skill sets, potentially displacing some traditional finance roles. Nurturing a workforce with the right blend of AI-related skills and financial expertise becomes a pressing concern.

Overreliance on AI: An overreliance on AI without human oversight can lead to overconfidence in algorithmic decisions. Striking the right balance between automation and human judgment is crucial to prevent catastrophic errors.

Addressing these multifaceted challenges requires a collaborative effort between financial institutions, regulators, and AI experts. While the potential and benefits of AI in finance are boundless, a vigilant approach is necessary to navigate the complexities and ensure a sustainable, secure, and ethically sound future.

Conclusion

In the realm of AI for finance, Artificial Intelligence (AI) has kindled a revolution that reverberates through every facet of the industry. From fraud detection to personalized planning, AI’s impact is profound, reshaping practices and elevating services.

With enhanced efficiency, data-driven insights, and advanced risk management, the future promises hyper-personalization, interconnected ecosystems, and an AI-augmented workforce.

At this crossroads, ValueCoders is committed to driving this transformation forward, ensuring ethical, responsible, and innovative integration of AI solutions for finance business services. Join us in shaping a future where finance meets intelligence.

Experience the Future Today!