With the aggregated estimate of $447 billion in potential cost savings for banks by 2023-24, the role of Artificial Intelligence has already become an integral part of their everyday life.

Many people think the future of finance is all about blockchain, cryptocurrencies, and Robo-advisors, but Artificial Intelligence can be the real game-changer in the finance industry.

It is already changing how firms in other industries operate, and it is the time for the finance industry to catch up to the revolution with finance AI solutions.

The financial services industry is vast and complex. It encompasses everything from retal banking and investment management to insurance and accounting. Due to its great scope, AI can improve work efficiency and cut costs in many different ways.

So, AI is playing a larger role in the finance industry than ever before, as organizations look for ways to improve customer experience and increase efficiency.

Here we have discussed all aspects of Artificial Intelligence in the finance domain to prepare your business for future growth.

Artificial Intelligence In Finance: An Overview

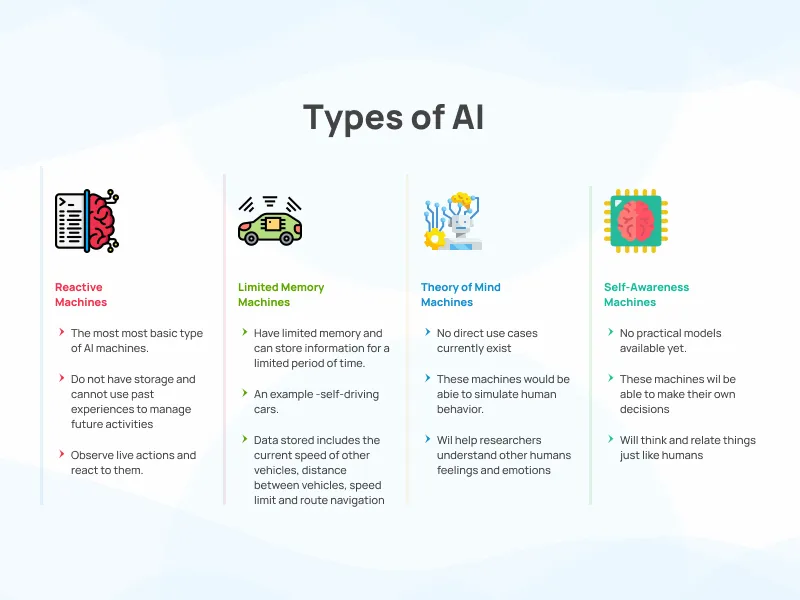

Artificial Intelligence is programming a computer to make decisions for itself. This technology is used in various ways in financial services, from automating customer service tasks to detecting and preventing fraud.

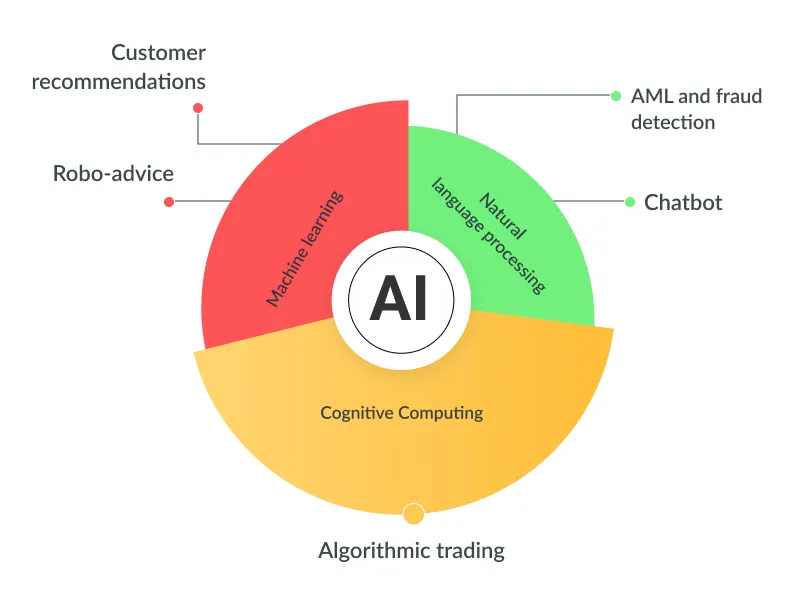

AI for financial operations solutions will undoubtedly continue to do so in the future. Here are some key areas where AI is changing financial services today.

- Predictive models help banks identify fraud before it happens by predicting which customers will be more likely to default on their loans.

- Deep learning can predict market volatility and place trades accordingly in seconds.

- Natural language processing (NLP) can answer basic queries or complete complicated transactions using voice commands or typing alone on a mobile device.

- Machine learning can predict customer preferences and suggest products accordingly without making errors like a human would make under pressure or when tired.

Explore the Impact of AI in the Finance Sector.

Watch Now! A Critical Role Of Artificial Intelligence in Finance:

Why Are Fintech Companies Opting for AI?

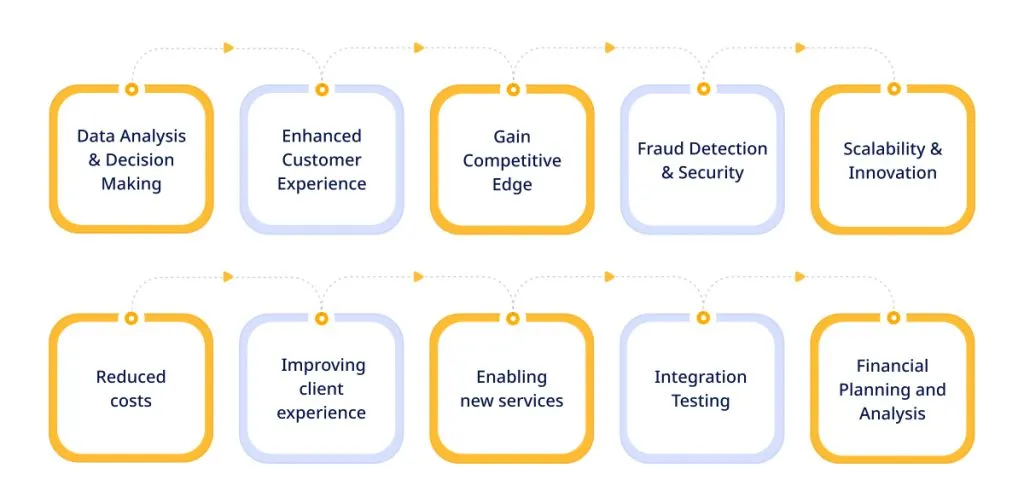

Fintech companies are turning to Artificial Intelligence (AI) for several reasons. Here are some specific ways that Artificial Intelligence development services can benefit businesses in the financial sector:

1. Data Analysis & Decision Making

AI helps shift large amounts of data more quickly & efficiently than humans can. This is important because fintech companies often have to make decisions based on constantly changing and evolving data.

2. Enhanced Customer Experience

AI help fintech development companies personalize their services for each customer by understanding each customer’s unique needs and preferences. Hence, fintech companies can provide a more customized experience that will likely lead to customer satisfaction and loyalty.

3. Gain Competitive Edge

The role of Artificial Intelligence in Financial Services Industry help your business stay ahead of the competition. As more companies enter the fintech space, those that can use AI to gain a competitive edge are likely to succeed in the long run.

4. Fraud Detection & Security

AI algorithms helps in detecting patterns of fraudulent behavior in real-time. It enhances security and reduces financial risks. Machine learning models along with AI analyze large volumes of data to identify anomalies and flag suspicious transactions.

5. Scalability & Innovation

AI elevates tech innovation by enabling fintech companies to quickly develop & deploy new services. By leveraging AI-driven insights, your business can stay ahead of competitors and adapt to evolving market demands.

Also Read – Understanding FinOps: A Comprehensive Guide

6. Reduced costs

AI for financial operations reduces costs in several ways, such as automating repetitive tasks and detecting and preventing fraud. For example, banks use AI-powered chatbots to handle customer service inquiries, which frees human employees to focus on more complex tasks.

7. Improving client experience

Financial institutions use AI to improve the client experience in various ways, including personalizing financial services based on individual needs, offering automated advice and recommendations, and using chatbots to interact with customers via text or voice.

8. Enabling new services

AI can help financial institutions innovate and create new products, services, and solutions for their clients. For example, AI has helped banks develop Robo-advisory platforms that use algorithms to help clients manage their money.

9. Financial Planning and Analysis

By automating repetitive and low-value tasks, AI can help financial institutions improve efficiency and focus on higher-value activities. Artificial intelligence development can also identify opportunities and risks, make better investment decisions, and provide personalized advice.

10. Improved Operational Efficiency

The financial sector has quickly adopted AI technologies to improve operational efficiency. AI can help identify and flag errors in financial documents, speed up the loan approval process and automate customer service tasks.

Financial institutions also use AI to detect fraudulent activity and protect against money laundering. To facilitate these AI implementations, financial institutions often rely on Workday developers. These developers can integrate AI tools with existing Workday systems, ensuring seamless data flow and efficient processing.

11. Increased Sales & Revenues

It is responsible for managing and regulating the flow of money and investment and providing essential services to businesses and individuals. The financial sector is constantly evolving and innovating to stay ahead of the competition and meet the ever-changing needs of its customers.

For all the above reasons, it is no wonder that many fintech companies opt AI in their business operations. As discussed, AI can offer many benefits to businesses in the financial industry, including improved decision-making, increased efficiency, and enhanced security.

Discover How AI is Reshaping Financial Services.

Top Industries Using Artificial Intelligence Technology

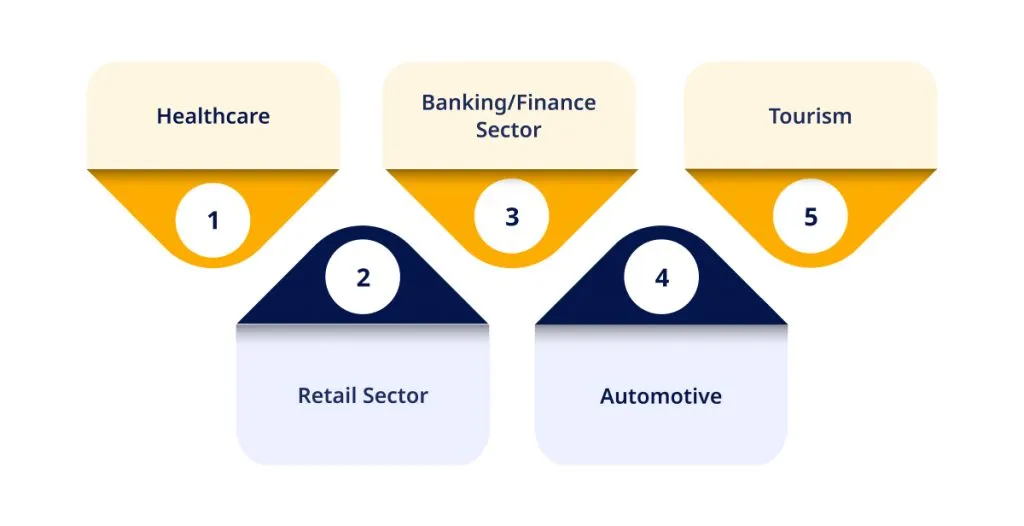

Artificial intelligence is widely adopted across various industries due to its transformative capabilities. Here we have listed some of these industries below:

- Healthcare: AI help doctors from identifying cancerous cells to diagonising patients to providing personalized care plans.

- Retail Sector: AI-powered chatbots helps in recommending products, selling and cross-selling products and providing customer support.

- Banking/Finance Sector: AI and ML in banking and insurance are transforming the industry by streamlining loan approval processes, providing investment recommendations, and enhancing fraud detection capabilities in banking solution companies.

- Automotive: AI is used for infotainment systems, autonomous vehicles and advanced driver assistance systems.

- Tourism: AI plays a large role in travel planning by suggesting tourist attractions based on user preferences and exploring new destinations.

Pro Tip: Hire AI developers from ValueCoders to achieve success for your business. Our Artificial intelligence development services will automate things and give you a unique customer experience.

Also Read: How Artificial Intelligence Is Redefining Success Of Digital Transformation Strategies?

Real-time Use Cases Of AI In Finance

AI has the potential to transform the financial services industry for the better. It can help improve efficiency, cut costs, and make processes easier for customers and employees.

From chatbots and digital assistants to fraud detection and risk management, AI is streamlining various processes and making them more efficient.

1) Fraud detection: AI help financial institutions detect fraud by analyzing patterns in customer data. By looking for anomalies like account activity, transaction history, and even social media activity, AI can flag potentially fraudulent activity for improved investigation.

2) Personalized Customer service: AI provides more personalized customer service. By understanding a customer’s individual needs and preferences, AI-powered chatbots and virtual assistants can provide a more tailored customer experience.

3) Claims Processing: AI streamlines the process by automatically verifying information and routing claims to the correct department. NLP algorithms extract & analyze information from claim forms/supporting documents. It enables faster & accurate claim adjudication.

4) Marketing: AI targets customers with personalized offers and advertisements. It boosts marketing efforts by using predictive analytics and preferences to deliver personlaized marketing campaign. It improves conversion rates and customer retention.

5) Portfolio management: AI for financial operations solutions helps investment managers decide where to allocate capital. It optimizes investment strategies and generate insights for making informed decisions. It continuously monitors portfolios and rebalance assets as per market conditions.

6) Risk management: AI can assist financial institutions in managing risk by identifying trends and patterns in data that humans might miss. Using historical data and machine learning, AI can help predict future risks to mitigate them.

7) Regulatory compliance: AI can be used to help financial institutions comply with regulations such as know-your-customer (KYC) and anti-money laundering (AML) rules.

Despite its potential, AI adoption in financial services has been slow due to various challenges, including data quality issues and a lack of understanding of how AI drives business value.

However, things are starting to change. Several financial institutions are beginning to experiment with AI, and there are signs that AI adoption will increase in the coming years.

Unlock new possibilities for your financial institution.

Future Of AI In Finance

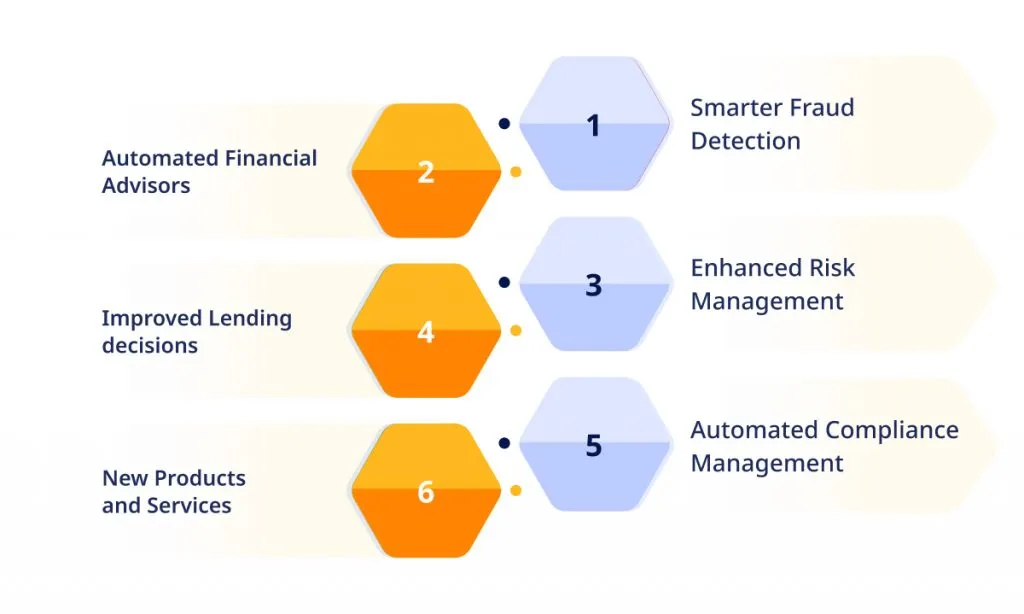

The future of AI in financial services is inspiring. With the rapid development of AI technology, financial institutions are looking to adopt AI in various ways to improve their operations and better serve their customers. Here are some of the ways AI is expected to impact financial services in the future:

- Smarter Fraud Detection: AI can help financial institutions detect and prevent fraud more effectively. For example, machine learning algorithms can be used to identify patterns of fraudulent behavior.

- Automated Financial Advisors: AI can be used to provide automated financial advice to customers. For example, Robo-advisors can provide portfolio recommendations based on a customer’s risk tolerance and investment goals.

- Enhanced Risk Management: AI can help financial institutions manage risk more effectively. For example, machine learning algorithms can identify potential risks and opportunities in real-time.

- Improved Lending decisions: AI can help financial institutions make better lending decisions by using data to assess a borrower’s creditworthiness.

- Automated Compliance Management: AI can automatically track regulatory requirements and ensure compliance at all times.

- New Products and Services: Finally, AI-powered products such as Robo advice platforms, virtual bank tellers, chatbots, and smart advisors are expected to disrupt the traditional banking sector over the next few years.

ValueCoders has a team of experts to suupport you leverage AI to your business.

Conclusion

AI is reshaping finance faster than any other sector and will continue for years. Beyond powering modern trading systems, it’s allowing companies to reduce risk and compliance costs and is improving all customer-facing channels, from phone service to online chat.

As technology evolves, we can expect AI to play an even bigger role in the financial sector, making it more efficient and effective.

If you want to leverage the benefits of the same, you can outsource your next project to a reliable Artificial Intelligence development company, i.e., ValueCoders or hire Artificial Intelligence developers as it has successfully done 4200+ projects and still counting.

Feel free to contact us today!