Have you ever wondered how your bank detects fraudulent transactions with pinpoint accuracy or how your insurance provider tailors policies to your unique needs? The answer lies in the world of AI and ML in banking & insurance, where these cutting-edge technologies are reshaping the landscape at an unprecedented pace.

Did you know that AI-powered chatbots are becoming increasingly popular in the banking industry to modernize the customer experience and remove friction from everyday banking tasks? Or machine learning algorithms are used in the insurance industry to detect and prevent fraudulent claims?

This blog will embark on a journey through the smart finance landscape, exploring the transformative power of AI and ML in banking & insurance. From revolutionizing customer experiences to optimizing risk assessment, get ready to navigate the horizon where artificial intelligence meets your financial future.

Understanding AI and ML in Finance

Artificial Intelligence and Machine Learning in banking & insurance have ushered in a remarkable era of innovation, transforming how the financial industry operates. To embark on this journey, let’s start with the basics.

Let us help you enhance profitability and competitiveness in insurance industry.

AI is the art of creating machines or software that can mimic human intelligence. It empowers computers in financial data analytics, recognizes patterns, and makes decisions, much like a human brain but with unmatched speed and accuracy.

On the other hand, ML, a subset of AI, focuses on developing algorithms that can learn from data and improve their performance over time. This means that ML models can adapt and evolve without explicit programming.

The roots of the benefits of AI and ML in FinTech trace back to the 1980s when early attempts were made to apply these technologies to trading strategies. However, in recent years, they’ve gained substantial traction, owing to advances in computing power and exponential data growth.

AI and ML in banking & insurance have become indispensable tools due to their ability to sift through vast datasets and deliver actionable insights in real-time. They enhance risk assessment, AI fraud detection, customer service, and investment strategies.

Moreover, they enable financial institutions to stay competitive and meet the evolving demands of an increasingly tech-savvy clientele.

Also Read: Best AI Development Companies To Get Innovative And Tech-Driven Solutions

The Current Landscape

In the ever-evolving realm of finance, AI and ML in banking & insurance are no longer mere buzzwords. They are the driving force behind transformative changes, shaping the industry’s current landscape.

As we stand at the crossroads of technological advancement, it’s crucial to grasp the significance of AI and ML in today’s financial world. Partnering with an AI services company for the adoption of these technologies has surged, and the results are tangible.

AI and ML Adoption

Financial institutions have integrated AI and ML into their core operations, from traditional banks to nimble FinTech startups. These technologies are deployed in diverse applications, from automating routine tasks to making sophisticated predictions about market trends.

Enhanced Customer Experiences

One noticeable impact has been on customer experiences. AI-driven financial chatbots provide instant responses to inquiries, while personalized recommendations powered by ML algorithms help customers make informed financial decisions. This level of service is reshaping expectations in the industry.

Risk Mitigation and Fraud Detection

In risk assessment, AI and ML excel at analyzing massive datasets to identify potential threats. AI fraud detection has become more robust, with algorithms continuously learning to recognize new fraud patterns.

Discover how AI can redefine your services.

Investment and Wealth Management

Investment strategies have also evolved. AI-powered robo-advisors offer tailored investment plans, making wealth management accessible to a broader audience. This democratization of finance is altering the investment landscape.

The Road Ahead

As AI and ML in banking & insurance continue to evolve, financial institutions must adapt to stay competitive. In the next sections, we’ll explore the myriad ways these technologies are being harnessed and their potential for shaping the future of finance. Buckle up for a journey through the dynamic landscape of smart finance.

Also read: Top AI Development Companies

AI and ML Applications in Banking

Integrating AI and ML in banking & insurance has brought forth a wave of transformative applications in finance. These technologies are reshaping how banks operate and interact with customers, offering efficiency, personalization, and security like never before.

Customer Service and Chatbots:

AI and ML’s Role: Artificial intelligence and machine learning development create chatbots capable of natural language processing. Such chatbots can understand and respond to customer inquiries, whether they come through a website, mobile app, or messaging platform.

Benefits: Chatbots respond instantly to common queries, offer personalized assistance, and operate round-the-clock. They free up human customer service agents to handle more complex issues.

Credit Scoring and Risk Assessment:

AI and ML’s Role: AI and ML models analyze a vast array of data, including credit history, income, employment status, and even non-traditional data like social media behavior. These models can identify patterns and trends that human underwriters might miss.

Benefits: More accurate credit scoring means banks can make better lending decisions, aiding digital financial management and bringing digital banking transactions reducing the risk of default and allowing for loan approval to individuals who might have been overlooked using traditional credit scoring methods.

Fraud Detection and Prevention:

AI and ML’s Role: AI and ML algorithms analyze transaction data in real-time, looking for patterns that indicate fraud. Furthermore, they can learn from new fraud methods, making them highly effective at spotting suspicious activity.

Benefits: Using predictive analytics in finance and detecting fraud early, banks can save millions of dollars and protect their customers from financial losses. Real-time fraud prevention also enhances trust among customers.

Also read: Artificial Intelligence Vs. Machine Learning Vs. Deep Learning: New Ethics Of Future Advancement!

Personalized Banking Experiences:

AI and ML’s Role: These technologies analyze customer data, including transaction history, spending habits, and interactions with the bank. They use this information to provide personalized product recommendations, such as suggesting suitable credit cards or investment options.

Benefits: Personalization enhances customer satisfaction and loyalty. Customers who feel their bank understands their unique needs will likely remain loyal and engage in additional financial services.

Algorithmic Trading:

AI and ML’s Role: Algorithmic trading uses the benefits of AI and ML in FinTech to make rapid trading decisions based on market data, news, and historical trends. These algorithms can execute trades in fractions of a second, reacting to market changes faster than human traders.

Benefits: Algorithmic trading can capture opportunities in the market that are difficult for human traders to exploit, due to the speed at which it operates. It can also reduce trading costs and minimize human biases.

Regulatory Compliance:

AI and ML’s Role: AI and ML monitor transactions and data for compliance with regulatory requirements, such as anti-money laundering (AML) and Know Your Customer (KYC) regulations. These technologies can flag unusual or suspicious transactions for further investigation.

Benefits: When you hire machine learning experts, financial institutions must ensure regulatory compliance to avoid fines and legal troubles. AI and ML automate and improve the accuracy of this process, reducing the risk of compliance violations.

Reduce processing time and increase approval rates with AI and ML.

These applications highlight the versatility of AI and ML in banking, where they improve efficiency, reduce risks, and enhance the overall customer experience. As these technologies advance, their impact on the financial sector will likely grow even further.

AI and ML Applications in Insurance

In the realm of insurance, the infusion of AI and ML in banking & insurance has ushered in a new era of efficiency, risk assessment, and personalized services. Here, we explore some of the key applications that are transforming the insurance landscape.

Underwriting and Risk Assessment:

AI and ML’s Role: These technologies analyze a wealth of data, including policyholder information, historical claims, and external factors like weather data or medical records. Algorithms can then assess risks more accurately, enabling insurers to set premiums more precisely.

Benefits: Insurers can offer policies tailored to individual risk profiles, attracting more customers while minimizing the risk of overpricing or underpricing policies.

Claims Processing:

AI and ML’s Role: AI and ML automate claims processing by extracting and analyzing information from claim documents, images, and even telematics data from IoT devices in vehicles. This accelerates claims settlements and reduces fraudulent claims.

Benefits: Faster claims processing improves customer satisfaction and reduces costs for insurance companies. Machine learning can also detect patterns associated with fraudulent claims, saving insurers substantial amounts.

Customer Service and Chatbots:

AI and ML’s Role: AI-powered chatbots respond instantly to customer inquiries, policy questions, and claims of status updates. These chatbots enhance the customer experience by offering quick, 24/7 support.

Benefits: Customers receive timely assistance, and insurers can efficiently handle a high volume of inquiries, freeing human agents to focus on complex issues.

Also Read: The convergence of AI/ML and Wearables: What’s in store for the Healthcare Industry

Fraud Detection:

AI and ML’s Role: Artificial Intelligence and Machine learning development models analyze historical claims data, policyholder behavior, and external data sources to identify unusual patterns that may indicate fraud. These models adapt to evolving fraud tactics.

Benefits: Fraud detection saves insurers substantial amounts by preventing fraudulent payouts and maintaining trust among policyholders.

Predictive Analytics for Risk Management:

AI and ML’s Role: Predictive analytics in finance use AI and ML to forecast future claims, assess risk factors, and optimize reinsurance strategies. This data-driven approach helps insurers manage risk more effectively.

Benefits: Improved risk management can lead to more stable pricing, better profitability, and increased competitiveness in the insurance market.

Personalized Policies:

AI and ML’s Role: Insurers can offer personalized policies and discounts by analyzing customer data and behavior. For instance, safe drivers may receive lower auto insurance premiums.

Benefits: Personalization enhances customer satisfaction and loyalty, making policyholders more likely to remain with the insurer.

AI and ML applications in insurance are revolutionizing the industry, making it more customer-centric, efficient, and competitive. As these technologies continue to evolve, insurance companies are poised to unlock even more value for both themselves and their policyholders.

Explore the future of personalized, efficient insurance solutions

Use Cases of AI and ML in Banking and Insurance

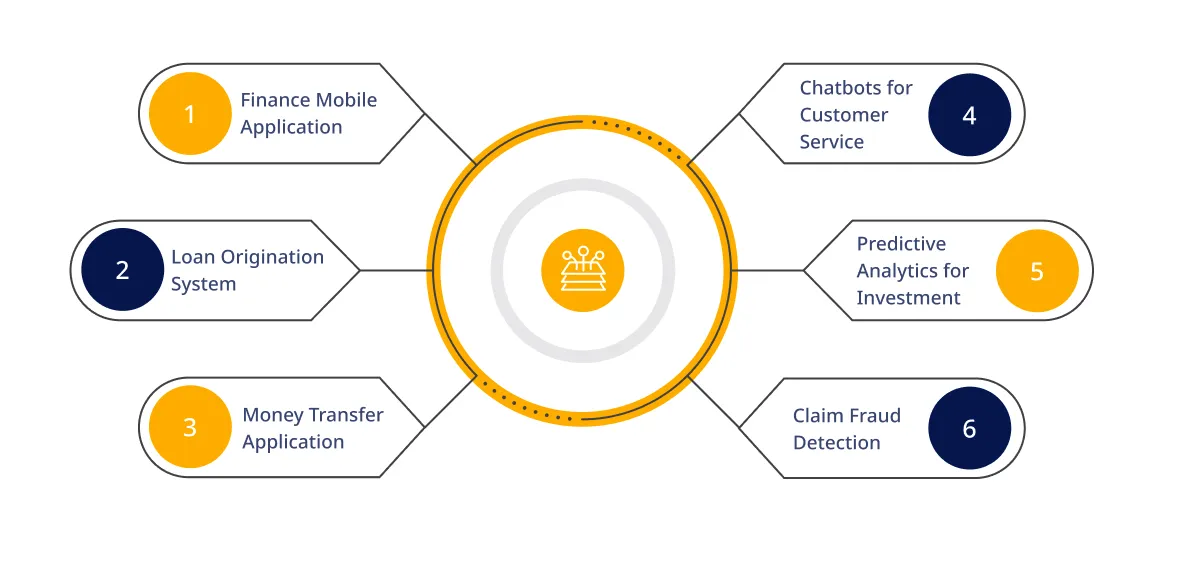

AI and ML in banking & insurance have transcended the realm of theory, manifesting in real-world applications that revolutionize how these industries function. Let’s explore some interesting use cases that demonstrate their transformative power:

Finance Mobile Application: Imagine a mobile app that not only allows you to check your account balance but also offers financial insights tailored to your spending habits. AI and ML make this possible by analyzing your transaction history to provide personalized financial advice. ValueCoders recently developed a Finance Mobile Application that incorporates AI and ML, transforming it into a financial advisor in your pocket.

Loan Origination System: Applying for loans can be cumbersome, involving extensive documentation and approval delays. AI and ML streamline this process by automating document verification, credit scoring, and risk assessment. ValueCoders successfully implemented an AI-driven Loan Origination System, reducing processing time and increasing approval rates.

Money Transfer Application: When it comes to transferring money, security is paramount. ML and AI play a significant role in detecting fraudulent transactions in real-time. ValueCoders engineered a Money Transfer Application with robust fraud detection capabilities, ensuring that your hard-earned money remains safe during transactions.

Chatbots for Customer Service: Customer service is critical to banking and insurance. AI-powered chatbots are used to respond instantly to customer queries, process routine transactions, and even offer product recommendations. This not only enhances customer satisfaction but also reduces operational costs.

Predictive Analytics for Investment: Investment decisions no longer rely solely on human judgment. AI-driven predictive analytics in finance analyze market trends, news, and historical data to make data-driven investment decisions in real-time. This approach improves the accuracy of investment strategies and maximizes returns for investors.

Claim Fraud Detection: Insurance fraud is a significant concern. AI and ML models continuously analyze claims data to detect patterns indicative of fraudulent activity. This not only saves insurers substantial amounts but also ensures that genuine claimants receive prompt settlements.

These use cases exemplify the immense potential of AI and ML in banking & insurance. As technology advances, more innovative applications that enhance customer experiences, improve efficiency, and mitigate risks across these industries can be expected.

Conclusion

In the ever-evolving world of finance, the horizon is undeniably smart, illuminated by the brilliance of AI and ML in banking & insurance. These technologies have transcended mere trends, becoming essential tools for innovation, risk mitigation, and personalized customer experiences.

As we navigate this exciting landscape, ValueCoders remains committed to empowering financial institutions with cutting-edge solutions. Our case studies, like the “Finance Mobile Application,” “Loan Origination System,” and “Money Transfer Application,” are a testament to our expertise in harnessing the potential of AI and ML.

The journey is far from over. Join us in shaping the future of smart finance. Together, we’ll unlock new horizons, drive efficiency, and create a more secure and accessible financial world.

Ready to embark on your AI and ML journey? Contact us today to explore the possibilities!