In the ever-evolving banking and finance sector landscape, one technological force stands out, reshaping the industry with remarkable prowess – Artificial Intelligence (AI).

AI in banking has ushered in a new era where customer-centricity, operational efficiency, and cost reduction converge to redefine the essence of financial services.

AI-based systems are no longer a vision of the future; they transform how banks operate and deliver customer services.

They enable institutions to harness the power of data, making decisions that surpass human capabilities. Intelligent algorithms can identify fraudulent activities in seconds, safeguarding customers and financial institutions.

As per a report from Business Insider, approximately 80% of banks have recognized the immense potential of Artificial Intelligence in banking and finance.

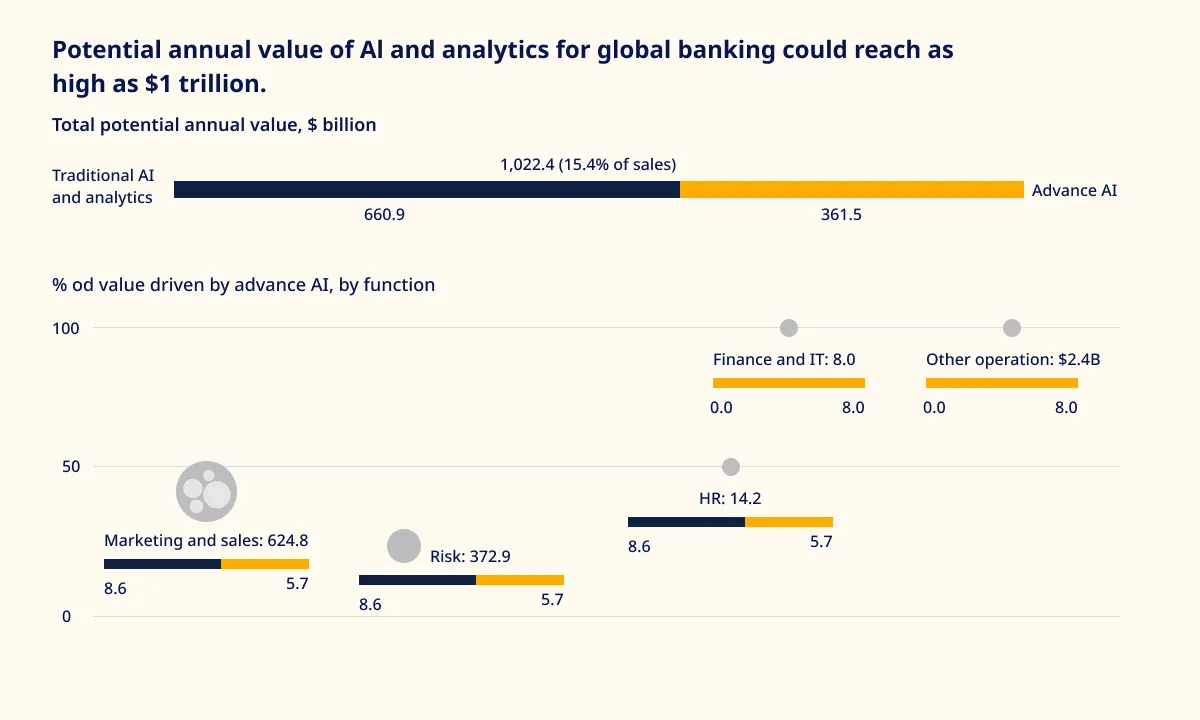

The forecasted figures from McKinsey paint an even more compelling picture, with the potential value of AI in the banking sector expected to reach a staggering $1 trillion.

This seismic shift towards AI in banking is undeniable, with a singular focus: to enhance efficiency, elevate service quality, boost productivity, and, ultimately, reduce costs.

In this exploration, we will delve into the pivotal applications of AI in the banking and finance sector, unveiling the transformative journey that is reshaping the customer experience and delivering an array of exceptional benefits.

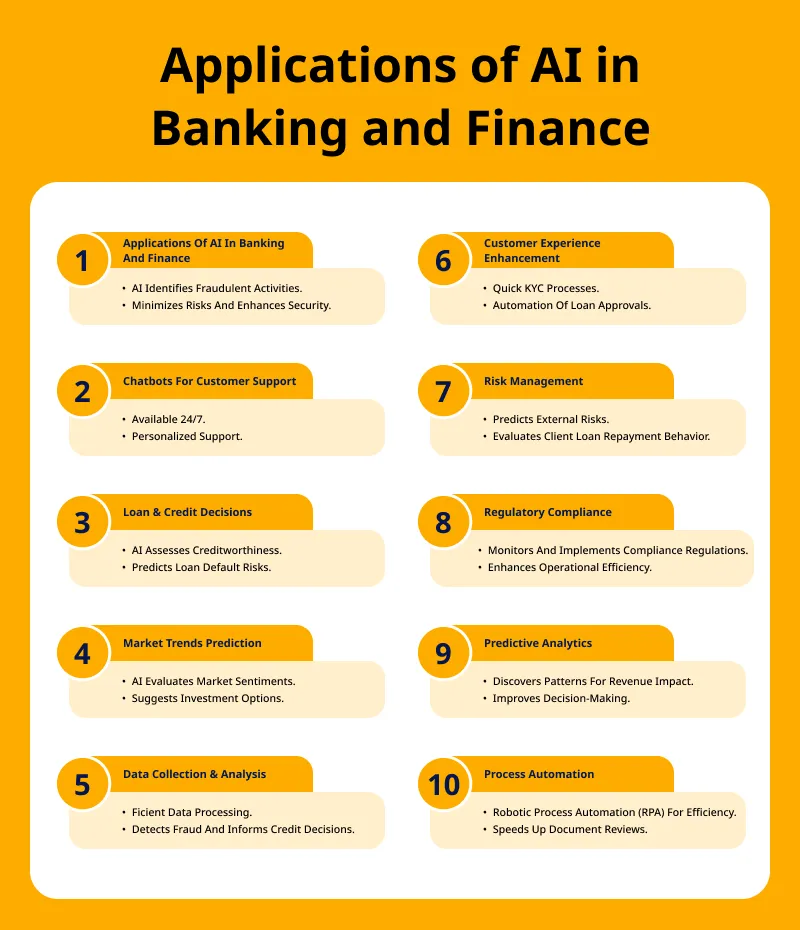

Applications of AI in Banking and Finance

In the dynamic world of banking and finance, Artificial Intelligence (AI) has seamlessly integrated itself into various aspects of the industry. Banks are harnessing the power of AI to enhance their products and services.

Partner with ValueCoders to discover how AI technology redefines banking excellence.

Here are some key applications and benefits of AI And ML in Fintech and banking sector:

Cybersecurity and Fraud Detection

With many daily transactions, including bill payments, withdrawals, deposits, and more, conducted through apps and online platforms, the banking sector faces an increasing need to bolster its fraud detection efforts.

AI and machine learning in banking and finance have emerged as crucial allies in this battle. They assist banks in identifying fraudulent activities, pinpointing vulnerabilities in their systems, reducing risks, and enhancing the overall security of online financial transactions.

Danske Bank, Denmark’s largest bank, is a testament to AI’s power in fraud detection. By implementing a deep learning-based fraud detection algorithm, the bank saw a remarkable 50% increase in its fraud detection capability and a 60% reduction in false positives.

Moreover, the AI-driven system streamlined essential decision-making processes while routing select cases to human analysts for further scrutiny.

The financial sector was the target of 29% of all cyberattacks in 2019, making it the most sought-after industry by cybercriminals.

AI, with its continuous monitoring capabilities, empowers banks to proactively respond to potential cyber threats before they impact employees, customers, or internal systems.

Artificial Intelligence in the banking sector is not just a trend but a transformative force that enhances security, safeguards against fraud, and strengthens the sector’s resilience against evolving threats.

Also Read: What Is The Role Of Artificial Intelligence In The Financial Sector?

Chatbots

In practical AI applications in banking, chatbots are a prime example of how technology reshapes the industry. These virtual assistants work tirelessly, 24/7, a feat unattainable by their human counterparts with fixed working hours.

Key Advantages of Chatbots in Banking:

- Continuous Availability: Unlike humans, chatbots never sleep or take breaks. They are always ready to assist customers, ensuring round-the-clock support.

- Learning and Adaptation: Chatbots can learn from a customer’s interaction history. This allows them to comprehend individual usage patterns and tailor their responses accordingly, enhancing efficiency.

- Personalized Support: By harnessing the insights gained from customer behavior, chatbots can offer personalized assistance, reducing the need for email exchanges and other communication channels.

- Financial Recommendations: Chatbots are proficient in recommending suitable financial services and products based on the customer’s specific needs and preferences.

Real-World Exemplar – Erica by Bank of America:

One example of AI chatbots in banking is Erica, the virtual assistant employed by the Bank of America. Erica is adept at managing credit card debt reduction and handling card security updates efficiently.

In 2019, Erica impressively handled over 50 million client requests, showcasing the potential of AI-driven chatbots in delivering exceptional customer service in the banking sector.

Chatbots powered by artificial intelligence in finance and banking are revolutionizing customer service in banking, ensuring customers have access to support whenever they need it, while also delivering personalized and efficient assistance.

Loan and Credit Decisions

Beyond Traditional Metrics: Many banks have traditionally relied on credit history, credit scores, and customer references to assess an individual or company’s creditworthiness.

However, these systems often must be corrected, miss real-world transaction history, and misclassify creditors. AI-powered loan and credit systems go further by scrutinizing customer behavior and patterns, especially for those with limited credit histories.

They can effectively gauge creditworthiness and even alert banks about specific behaviors that heighten the risk of default. AI is ushering in a future where consumer lending decisions are more informed and secure.

Tracking Market Trends

Data Processing Powerhouse: AI and Machine Learning (AI-ML) in financial services equip banks with the capability to process vast volumes of data. This empowers them to not only analyze market trends but also predict them accurately.

Advanced machine learning techniques delve into market sentiments, providing valuable investment suggestions. AI solutions for banking even determine the optimal moments for stock investments while issuing timely warnings about potential risks.

With their high-speed data processing capabilities, AI technologies expedite decision-making and offer a more convenient trading experience for banks and their clients.

Artificial Intelligence in the banking industry is transcending traditional credit assessment methods and market analysis, ushering in a new era where data-driven insights and predictive intelligence drive profitability, risk mitigation, and informed investment decisions.

Explore customized AI solutions with ValueCoders to stay ahead.

Data Collection and Analysis

Banking institutions handle millions of daily transactions, leading to an overwhelming volume of data. The manual collection and registration of such vast data become unmanageable and error-prone.

Innovative AI solutions come to the rescue, streamlining the data collection and analysis process. This not only ensures accuracy but also enhances the overall user experience. One can harness the same data for fraud detection and making informed credit decisions, further fortifying the financial ecosystem.

Elevating Customer Experience

Customers are perpetually seeking enhanced experiences and greater convenience. A classic example is the success of ATMs, which allowed depositing and withdrawing money beyond banking hours.

The quest for convenience has fueled innovation. Due to AI integration, customers can now open bank accounts from the comfort of their homes using their smartphones.

The technology expedites Know Your Customer (KYC) information recording, minimizes errors and ensures the timely release of new financial products and offers. AI in FinTech automates eligibility assessments for services like personal loans, sparing clients the tedious manual process.

Moreover, AI-based software accelerates approval times for loan disbursements and optimizes customer service by accurately capturing client information for account setup, eliminating errors, and ensuring a seamless customer journey.

AI’s influence in banking goes beyond data management; it extends to an elevated customer experience rooted in convenience, efficiency, and error-free service.

Risk Management

Risk Management

External global factors like currency fluctuations, natural disasters, and political unrest profoundly influence banking and financial industries. During these turbulent times, exercising caution in business decisions becomes paramount.

Generative AI Analytics: Generative AI services in banking provide advanced analytics that offers insights into future scenarios, enabling proactive and well-informed decisions.

By analyzing historical behavioral patterns and smartphone data, AI aids in identifying risky loan applications, assessing the likelihood of repayment defaults, and preparing banks to face the challenges of a volatile world.

Regulatory Compliance

Banking operates in one of the most tightly regulated sectors globally, with governments wielding regulatory authority to ensure financial integrity and risk mitigation.

In banking, AI and Machine Learning (ML) leverage deep learning and Natural Language Processing (NLP) to efficiently decode and implement evolving compliance requirements.

While AI doesn’t replace compliance analysts, it significantly accelerates their operations, ensuring banks stay abreast of changing regulations without cumbersome investments of time and resources.

AI’s role in banking extends beyond data analysis; it is a guardian of foresight and regulatory adherence, enabling a resilient and compliant financial ecosystem.

Predictive Analytics

AI in banking and financial services unlocks the potential for uncovering specific patterns and correlations in data that were previously elusive to traditional technology.

These patterns often harbor untapped sales opportunities, cross-selling potential, and operational data metrics. The result is a direct impact on revenue generation, redefining the way banks seize business opportunities.

Process Automation

Robotic Process Automation (RPA) algorithms drive operational efficiency by automating repetitive tasks. This not only boosts efficiency but also reduces costs, enabling human resources to focus on more intricate processes that demand their expertise.

Real-World Example: JPMorgan Chase’s CoiN technology exemplifies the success of RPA in banking. It reviews documents and extracts data with unparalleled speed, outpacing human capabilities. RPA’s transformational impact is not limited to banking; it extends its reach into sectors like insurance, revolutionizing processes, and enhancing productivity.

AI’s application in banking catalyzes insightful decision-making and operational efficiency, reshaping how financial institutions harness data and automate tasks, ultimately advancing the industry’s capabilities.

AI in Banking: Real-World Examples

As the banking sector continues its dynamic evolution, the integration of Artificial Intelligence (AI) has become a prevailing theme.

Several prominent banking institutions have already harnessed AI’s capabilities to elevate their services, bolster cybersecurity, and enhance customer experiences.

Here are noteworthy real-world examples of artificial intelligence in banking:

JPMorgan Chase: Early Warning System

Researchers at JPMorgan Chase have developed an early warning system that employs AI and deep learning techniques to identify malware, trojans, and phishing campaigns.

This system offers invaluable pre-attack warnings, alerting the bank’s cybersecurity team before malicious attacks unfold. It also issues alerts as hackers prepare to deploy harmful emails, fortifying network security.

Capital One: Eno and Fraud Prevention

Capital One boasts Eno, an intelligent virtual assistant that exemplifies AI in personal banking. It enhances customer interactions and provides real-time assistance.

The bank also employs virtual card numbers to combat credit card fraud. Furthermore, Capital One is delving into computational creativity, training computers to be creative and explain their creative processes.

Investment Banks: Analytical AI Tools

Investment banks like Goldman Sachs and Merrill Lynch have seamlessly incorporated AI-based analytical tools into their daily operations.

AlphaSense, an AI-based search engine employing natural language processing, assists in discovering market trends and conducting in-depth keyword searches, enhancing the banks’ market analysis capabilities.

These real-world examples of AI in banking underscore AI’s significant role in the banking industry, from fortifying security to enhancing customer interactions and revolutionizing operational efficiency.

Adopting AI technology is not just a trend but a transformative force in the banking landscape.

Also read: Smart Finance’s Horizon: Navigating AI And ML In Banking & Insurance

Challenges in Embracing AI & ML in Banking

Integrating advanced technologies such as AI in the banking industry presents many challenges. Here, we delve into the primary hurdles banks encounter when adopting AI and ML:

Data Security:

- Enormous Data Volumes: Banks accumulate massive amounts of data, necessitating robust security measures to prevent breaches and violations. Selecting a proficient technology partner with a deep understanding of AI and banking is vital.

- Customer Data Protection: Maintaining customer data’s security and integrity is paramount. AI solutions should come with various security options to handle sensitive information appropriately.

Lack of Quality Data:

- Data Prerequisite: High-quality, structured data is indispensable for the training and validating of AI-based banking solutions. Quality data ensures that algorithms can be applied effectively to real-life scenarios.

- Privacy and Compliance Risks: If data is not in a machine-readable format, it may lead to unexpected AI model behavior. Banks pursuing AI adoption must adapt their data policies to mitigate privacy and compliance risks.

Lack of Explainability:

- Bias and Decision-Making: AI-based systems are crucial in decision-making processes, improving efficiency and reducing errors. However, they can inherit biases from prior instances of human judgment errors.

- Risk to Reputation: Even minor inconsistencies in AI systems can swiftly escalate into significant problems, jeopardizing the bank’s reputation and functionality.

Banks must ensure adequate explainability for all decisions and recommendations offered by AI models. Understanding, validating, and elucidating the decision-making process is imperative.

In the realm of AI in banking, these challenges necessitate thoughtful strategies and comprehensive solutions to ensure that the benefits of AI in banking are harnessed while mitigating potential risks.

Utilize AI's full potential in banking with ValueCoders' tailored services.

The Imperative of an AI-First Banking Sector

In the swiftly evolving landscape of modern banking, the imperative to embrace an AI-first approach is undeniable, and the reasons are compelling:

Customer-Centric Transformation

Banking has transitioned from being people-centric to customer-centric. This transformation compels banks to adopt a more holistic approach to meet their customers’ ever-evolving demands and expectations.

In this era, customers expect round-the-clock availability and scale from their banks. AI is the key enabler for banks to deliver on these expectations efficiently.

Internal Challenges

Banks grapple with challenges like legacy systems, data silos, asset quality issues, and constrained budgets. These hurdles hinder swift responses to customer demands.

Many banks have turned to AI as a catalyst for change. It offers a solution to overcome internal constraints and empowers banks to evolve with customer needs.

To become AI-first, the banking sector is navigating its internal challenges to cater to a customer base that demands more accessibility, responsiveness, and scalability. AI serves as the compass guiding this transformation.

Steering Towards an AI-First Banking Paradigm

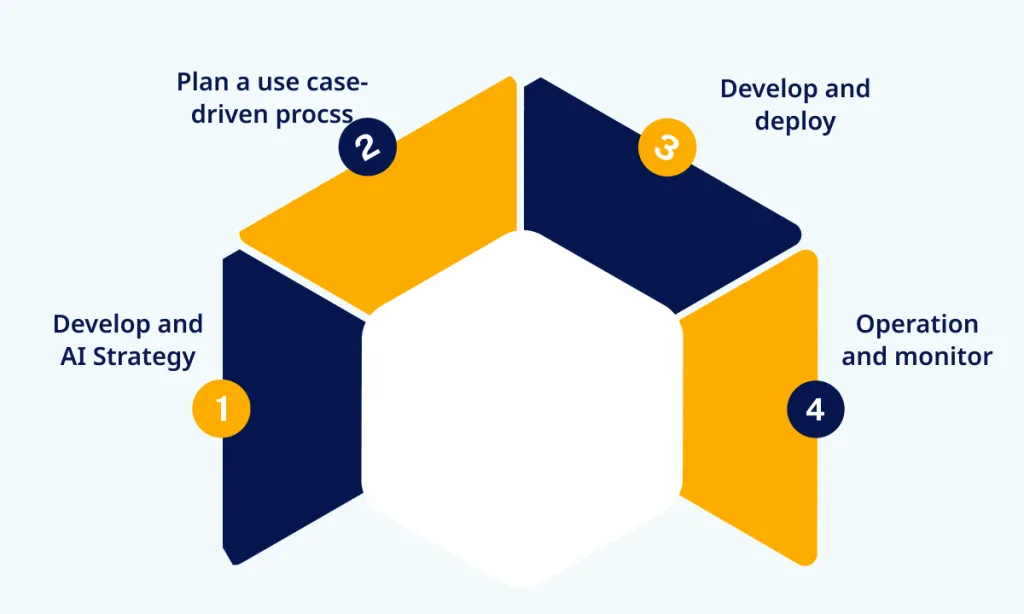

Becoming an AI-first bank is a meticulous process encompassing four pivotal dimensions: people, governance, process, and technology.

Here are the essential steps for banks venturing into this transformative path:

Step 1: Develop an AI Strategy

Strategic Foundation: Commence the AI transformation with an enterprise-level strategy firmly rooted in the organization’s goals and values.

Market Research: Conduct in-depth internal market research to identify gaps in people and processes that AI technology can bridge. Ensure that the strategy aligns with industry standards and regulations.

Internal Refinement: Refine internal practices and policies related to talent, data, infrastructure, and algorithms. This ensures clear direction and guidance for AI adoption across various functional units.

Step 2: Plan a Use Case-Driven Process

Identify High-Value Opportunities: Identify the most valuable AI opportunities that align with the bank’s processes and strategies.

Feasibility Evaluation: Assess the extent to which AI solutions need integration into existing or modified operational processes. Evaluate AI use cases and run feasibility tests to identify gaps.

Talent Mapping: Map out the necessary AI talent, including algorithm programmers and data scientists. Collaboration with technology providers can be considered if in-house expertise needs to be improved.

Step 3: Develop and Deploy

Prototyping: Prior to full-scale development, AI development company build prototypes to understand technology limitations. Test these prototypes with relevant data to train the AI model accurately.

Trial Interpretation: After training the AI model, conduct trials to interpret results, gauging real-world performance.

Deployment: Roll out the trained model for production use. The model can be continually improved and updated as more data flows in.

Step 4: Operate and Monitor

Continuous Monitoring: Implement continuous monitoring and calibration processes. Design a review cycle to assess the AI model’s functionality comprehensively.

Data Quality Assurance: Acknowledge the impact of new data on AI models during operation. Implement measures to ensure data quality and fairness.

Becoming an AI-first bank demands meticulous planning, implementation, and ongoing monitoring. By strategically integrating AI into banking operations, institutions can stay agile, secure, and responsive in a dynamic financial landscape.

Embark on a transformative journey with us to turn your idea into impactful digital solutions.

Unlocking the Potential of AI in Banking with ValueCoders

AI and banking are increasingly intertwined, with AI’s numerous advantages propelling the financial industry into a new era.

A McKinsey report reveals that 60% of financial services companies have already harnessed AI to streamline their business processes, underscoring the bright future of AI in banking.

The transformation brought by AI is poised to reshape the banking landscape, offering the potential to enhance processes, reduce errors, and elevate the customer experience.

In this era of AI-driven innovation, every banking institution has a compelling reason to invest in AI solutions, offering their customers novel experiences and impeccable services.

ValueCoders, a prominent artificial intelligence services company, specializes in high-end FinTech software development. We collaborate with banks and financial institutions, crafting tailored AI and ML models that bolster revenue, curtail costs, and mitigate risks across various departments.

We are among the top AI development companies whose proficient experts deeply understand artificial intelligence and are well-versed in the banking industry’s unique challenges. They stand ready to assist you in crafting AI-powered solutions that enhance risk management, streamline operations, and elevate the customer experience.

Connect with our experts today to establish and execute a forward-looking AI in banking strategy that aligns seamlessly with your technological requirements. Let’s embark on this AI-powered journey together, unlocking possibilities for your institution.

Ready to Transform Your Banking Experience with AI? Reach Out to ValueCoders Today for AI Consulting Services!

Risk Management

Risk Management