Fintech industry is transforming the way with approach and engage with the money. As per Deloitte, the Fintech market will rise to $174 in 2023 and even further to $188 billion by 2024.

To make the most of this technology, businesses need to know and follow the rules of the game. What is we tell you that at ValueCoders, we have re-written the Fintech rules many a times?

Yes, you heard it right!

Through our innovative custom applications, ValueCoders has disrupted the status quo and redefined the essence of financial technology.

So, let us take you through our journey of creating bespoke solutions that tranformed the Fintech arena, setting new benchmarks and paving the way for a brighter, more efficient financial future.

Evolution of Fintech & Its Disruptive Potential

Fintech has brough a seismic shift in the financial industry. It has not only replaced the conventional methods of finance but also ushered in new, inventive solutions to rectify the sector’s issues.

Limitations of the traditional finance industry

Fintech technology has emerged as a response to the limitations of the traditional financial industry. Let’s look at the major limitations of the traditional finance industry:

- Inefficiency: The traditional financial system has manual processes, which often result in slow and inefficient services.

- Limited Access: The traditional financial industry has struggled to provide financial services to underserved populations, particularly in developing countries. As a result, a significant portion of the global population unbanked or underbanked.

- High Costs: Traditional financial services were expensive, with high transaction fees, account maintenance, and other services.

Also Read: Streamlining Finance: The Benefits of AI and ML in Fintech

The Potential of the Fintech Industry

The disruptive potential of fintech software development services lies in its ability to:

- Streamline processes: Fintech solutions help automate manual processes, reduce operational costs, and improve efficiency for faster transactions & better customer experience.

- Expand access: Fintech companies provide services to underserved populations through digital platforms, breaking down barriers to entry and promoting financial inclusion.

- Lower costs: Fintech companies offer affordable fintech technology services accessible to a broader range of consumers and businesses.

Moreover, the fintech industry offers space for innovation. New technologies and business models are constantly emerging to disrupt traditional financial services.

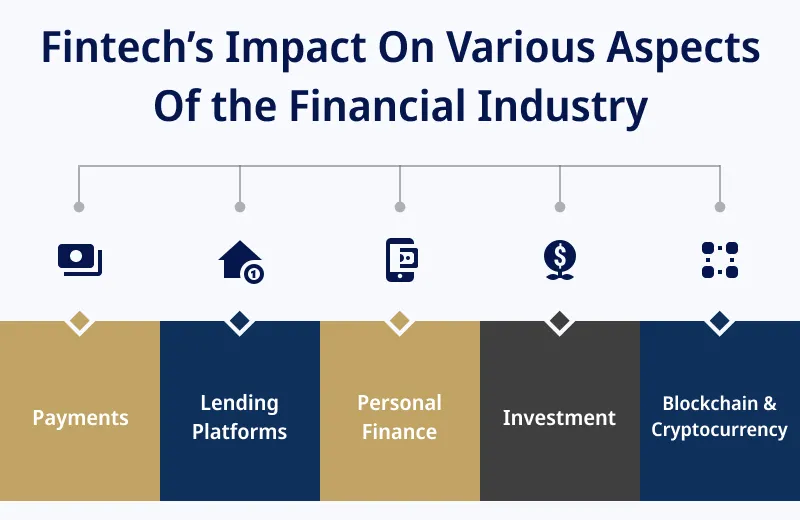

Some key areas of innovation include

Blockchain & Cryptocurrencies

Blockchain technology has changed how we execute financial exchanges by offering heightened protection, clarity, and expedience. Cryptocurrencies such as Bitcoin and Ethereum have been enthusiastically embraced, competing with traditional money.

Artificial Intelligence & Machine Learning

Financial organizations can access and study massive amounts of data using AI and machine learning. This helps them make more accurate decisions, automate operations, and offer tailored services to customers.

Open Banking & APIs

Open banking has spurred the creation of Application Programming Interfaces (APIs) that permit third-party developers to generate novel financial services and products, thus leading to heightened competition and invention in the sector.

With fintech technology constantly transforming, revolutionary developments will continue redefining the financial sector and revolutionizing how we manage our finances.

Embrace the future with our Fintech solutions

Custom Applications By Valuecoders: Redefining the Fintech Landscape

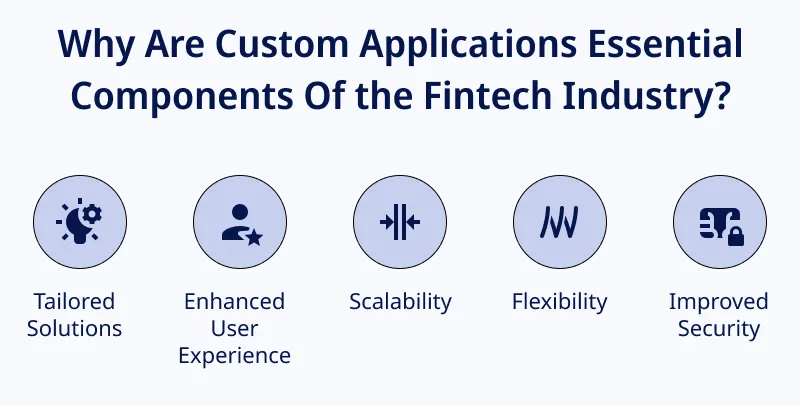

ValueCoders’ custom applications have successfully addressed industry-specific challenges, helping financial institutions stay competitive and adapt to the ever-changing fintech landscape.

Being a leading fintech application development company, ValueCoders has demonstrated the power of custom applications in transforming the financial services sector by rewriting the fintech rulebook. We can understand this below:

- ValueCoders’ custom apps have helped financial institutions streamline processes by automating manual tasks and improving efficiency.

- They have enabled financial institutions to harness the power of data analytics, providing valuable insights into customer behavior and market trends.

- ValueCoders’ custom apps have helped financial institutions comply with ever-changing regulations and industry standards.

- Their custom applications seamlessly integrate with existing systems and platforms, allowing financial institutions to leverage their current infrastructure.

Also Read: How Has Blockchain Evolved FinTech For 2024?

Ongoing Innovation in the Fintech Industry

The fintech industry is advancing rapidly, driven by inventive progress & the increased need to adapt to customers’ changing requirements.

As it continues to evolve, we can expect to see several advancements in custom software development as listed below:

Increased Use of AI and Machine Learning

As AI and ML technologies advance, integrating these tools into bespoke fintech applications will increase, providing the power to analyze data more accurately and make decisions more innovatively.

Expansion of Blockchain Applications

Blockchain technology can potentially transform many facets of technology in finance. This includes:

- Supply chain management

- Identity authentication

- International transactions.

Moreover, custom applications will be essential to maximize the possibilities of this cutting-edge technology.

Greater Emphasis on Cybersecurity

The rapid growth of the fintech technology sector necessitates that customized application development includes robust security protocols to safeguard sensitive financial information and keep customer trust.

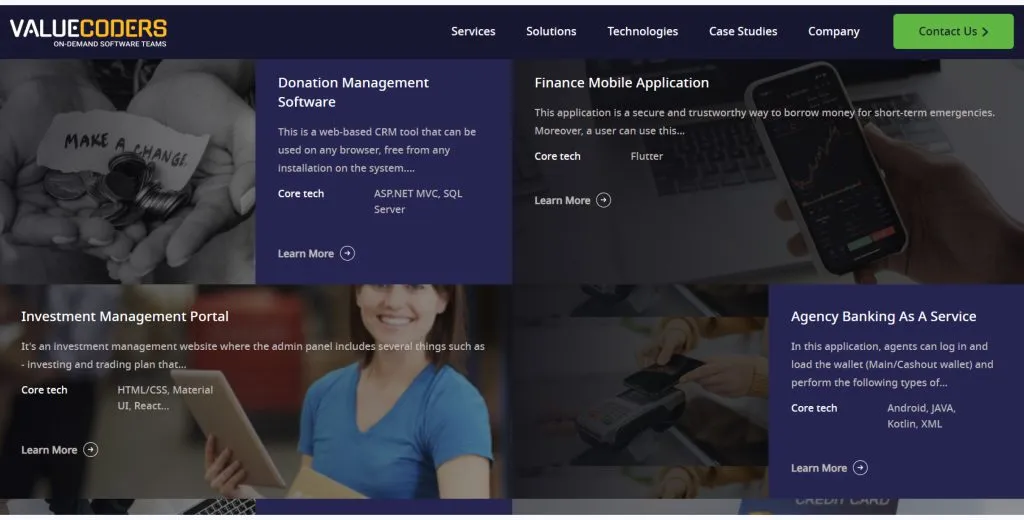

Successful Case Studies Developed by ValueCoders

1) Finance Mobile Application

Developed by our experts, the application facilitates quick & secure transactions. It allows users to access loans with attractive interest rates, flexible tenures, and an easy documentation process.

Challenges We Faced

- Developing flexible and attractive interest rates, easy documentation process, and quick disbursal for existing customers.

- Developing an intuitive & scalable mobile platform to offer a seamless experience to customers.

- Providing client service remotely by guiding individuals about the management of strict processes.

Solutions We Developed

- We offer attractive loans with an online personal loan EMI calculator, online disbursal, flexible tenures, and reasonable interest rates.

- Our team incorporated biometric login, simplifying the lending process on the home screen.

- We conducted several stakeholder interviews to understand the objectives and ensure the overall design and platform aligned with them.

Key Features of the Finance Mobile Application

- Expense Tracking

- Budget Management

- Financial Goals

- Bill Reminders

- Financial Reports

- Multi-currency Support

- Data Security

2) Investment Management Portal

This web-based platform streamlines the investment process for investors and asset managers. It offers features, viz., portfolio management, risk analysis, and performance tracking.

Challenges We Faced

- Complex data management and analysis requirements.

- Need for a scalable and secure platform.

- Integration with third-party data providers.

Solutions We Developed

- Leveraging advanced data analytics tools to process and analyze large volumes of data.

- Implementing robust security measures to protect sensitive data.

- Developing a scalable architecture to accommodate future growth and expansion.

- Integrating with third-party data providers to ensure real-time market insights.

Key features of the Investment Management Portal

- Customizable dashboards

- Advanced analytics & reporting tools

- Secure document storage

- Third-party data integration

Elevate your business with our Fintech app development

3) Agency Banking As A Service

We designed the solution to enable technology in financial institutions to expand their reach. It offers banking services through a network of agents.

Challenges We Faced

- Requirement for a user-friendly interface for agents and customers.

- Real-time transaction processing and reporting requirements.

- Integration with existing banking systems.

Solutions We Developed

- Developing a user-friendly interface for agents to manage customer transactions.

- Implementing real-time transaction processing and reporting capabilities.

- Integrating with existing banking systems to ensure seamless operations.

- Implementing robust security measures to protect sensitive customer data.

Key Features of Agency Banking As A Service

- User-friendly interface

- Real-time transaction processing &reporting

- Robust security measures

- Integration with existing banking systems

4) Order Payment Website

This eCommerce platform streamlines the shopping experience with an effortless checkout process, various payment choices, and solid fraud-avoidance tools.

Challenges We Faced

- Need for a streamlined checkout process.

- Support for multiple payment methods.

- Advanced fraud detection and prevention requirements.

Solutions We Offered

- Developing a streamlined checkout process for quick and easy transactions.

- Supporting multiple payment methods via credit cards, digital wallets, bank transfers.

- Developing advanced fraud detection & prevention tools to protect data.

- Integrating with popular e-commerce platforms for seamless order processing.

Key Features of the Order Payment Website

- Streamlined checkout process

- Multiple payment methods

- Advanced fraud detection tools

- Integration with eCommerce platforms

5) Blockchain Wallet App

This application allows users to maintain control of their digital assets with its high-level security and transparency features. It offers assurance that their digital assets will remain secure and can be exchanged without worry.

Challenges We Faced

- Need for secure storage & encryption of private keys.

- Support for multiple cryptocurrencies.

- Real-time market data and price alerts requirements.

Solutions We Implemented

- Implementing secure storage & encryption of private keys for enhanced security.

- Supporting multiple cryptocurrencies viz. Bitcoin, Ethereum, Litecoin.

- Providing real-time data & price alerts to help users stay informed.

- Developing an intuitive interface for easy navigation & asset management.

Key features of the Blockchain Wallet App

- Multiple cryptocurrencies

- Secure storage & Encryption

- Real-time market data & price alerts

- User-friendly interface

Read More: Healthcare App Ideas: 20+ Ideas For Healthcare Professionals

ValueCoders: A Game Changer in Fintech

ValueCoders, a top fintech software development company, has a proven track record of delivering successful fintech solutions, with expertise in digital banking, payment processing, lending platforms, and financial management systems.

With expertise in the fintech technology domain, we have become a trusted partner for businesses.

What Gives Us an Edge?

- We are a leading custom app development company with over 18 years of experience in delivering high-quality software products.

- With a team of 450+ skilled developers, we have completed over 4,200 projects.

- We help businesses streamline their operations, enhance customer experiences, and drive growth by understanding their unique challenges.

- We work closely with clients and address specific business needs.

- Our unwavering commitment to delivering custom applications sets us apart from other fintech technology providers

Discover the potential of our advanced Fintech apps

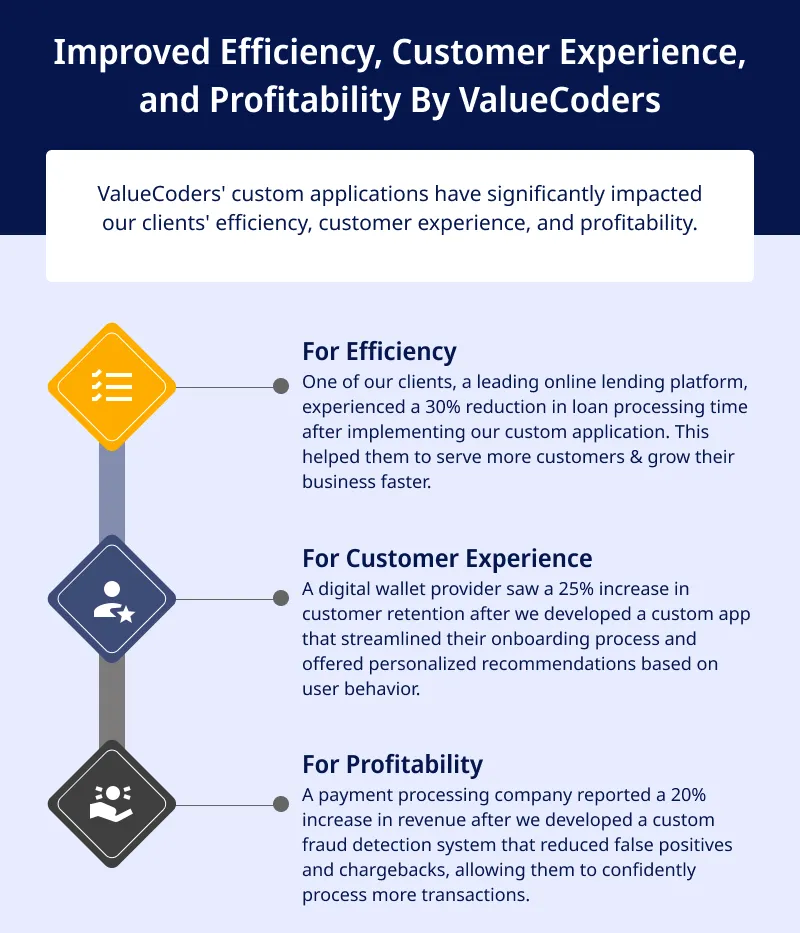

Impact of ValueCoders’ Custom Applications

At ValueCoders, we develop custom applications that meet our client’s unique needs and deliver tangible benefits that drive growth and success.

Benefits Experienced by Clients

Our clients have reported numerous benefits after implementing ValueCoders’ custom applications, as listed below:

Streamlined Operations

Our custom apps have helped businesses automate manual processes, reducing human error and saving valuable time, allowing them to focus on more strategic tasks, thus improving their overall operational efficiency.

Enhanced Decision-Making

Our custom applications have empowered businesses by providing real-time data and analytics. It helps make more informed decisions, leading to better fintech technology outcomes and increased competitiveness in the market.

Improved Customer Engagement

Our custom applications have enabled businesses to offer personalized experiences to their customers, thus, resulting in higher satisfaction levels and increased loyalty.

Client Testimonials and Success Stories

Our clients’ success stories speak volumes about the impact of ValueCoders’ custom applications.

Here are a few testimonials that showcase the value we bring to our clients:

“Our business has seen immense improvement due to ValueCoders’ tailored application. It has streamlined our operations, optimized our decision-making, and provided a higher level of service to our customers, all of which have made us incredibly content.” – Kris Bruynson, Director, Storloft

“The custom application developed by ValueCoders has improved our customer experience and significantly increased our profitability. Their expertise in fintech and dedication to our success has made them an invaluable web app development company and partner.” – James Kelly, Co-founder, Miracle Choice.

“ValueCoders has proved to be an excellent choice for us. Their fraud detection system has provided us with a safe environment to increase our financial transactions and, as a result, generate more revenue. We highly suggest their services to any fintech organization striving for excellence.” – Adam Watts, COO, Fintex Advisors.

Empower your brand with custom Fintech app development

Future Prospects & Innovation By ValueCoders

At ValueCoders, we are devoted to keeping pace with current trends and embracing emerging technologies to provide our customers with bespoke application solutions that redefine their performance standards.

We are contributing to the fintech industry by forecasting future advances & adjusting our plans accordingly, reshaping the delivery of fintech technology services.

Some of the ways we stay ahead of the curve include:

Continuous Learning: Our experts are committed to staying up-to-date with the latest industry trends & technological advancements through ongoing education & training.

Collaborative Approach: We work closely with our clients to understand their unique needs & challenges. This allows us to develop tailored solutions that address the client’s specific requirements.

Agile Development: Our agile development methodology enables us to quickly adapt to changes in the market and respond to new trends & challenges. We ensure that our clients always receive the most innovative and effective solutions.

Conclusion

As we reflect on our remarkable journey as a leading application development company in the fintech industry, it is clear that our bespoke applications have not only rewritten the fintech rulebook but have also paved the way for a new era of innovation.

We have successfully delivered tailored solutions by harnessing cutting-edge technologies and leveraging our extensive industry expertise. We address the distinct requirements of our clients to empower them to stay ahead in a rapidly evolving financial landscape.

We are passionate about revolutionizing the world of fintech through our custom applications.

Hence, we invite you to join us on this transformative journey as we redefine fintech rules and revolutionize the finance domain’s technology, one bespoke application at a time.

Contact us today!